CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFD Trading vs Investing vs Forex vs Options: What is the difference?

Which of the popular ways to approach financial markets might be suitable for your goals? CFDs, Investing, Forex, or Options all have different features worth exploring. It comes down to knowing the differences between them, understanding yourself and your goals and picking the one that is right for you.

This guide to CFD trading vs investing vs forex vs options is your one-stop shop to help learn the differences and decide which one (or two!) approach(es) could work for you.

This guide to CFD trading vs investing vs forex vs options is your one-stop shop to help learn the differences and decide which one (or two!) approach(es) could work for you.

QUOTE

You can’t predict. You can prepare.

Big ideas

- Unlike traditional investing, CFD and Forex trading allow you to speculate on falling markets, as well as rising ones. Options strategies can even be direction-neutral, focusing instead on movements in volatility – whether higher or lower.

- Forex markets run 24 hours a day, 5 days a week, making them more continuously available than stocks or options, which typically trade during set exchange hours.

- Investing focuses on building value gradually over time, whereas trading whether done through CFDs, forex, or options is more about reacting to short-term price movements.

- CFDs and forex both use leverage to amplify exposure, but the risks and margin requirements can vary a lot, especially when compared with completely unleveraged long-term investments.

What is CFD trading?

This first section of the article explains how CFD trading works and covers the differences of CFDs vs investing, forex, and options.

Definition of CFD (Contract for Difference)

CFD trading is about speculating on price movements without owning the asset you are trading.

It can be a share, a commodity, an index or a currency pair but either way you are not buying the asset itself, you are entering a contract that reflects its price change between the time you open and close the trade.

It can be a share, a commodity, an index or a currency pair but either way you are not buying the asset itself, you are entering a contract that reflects its price change between the time you open and close the trade.

How CFD trading works

A Contract for Difference (CFD) ultimately works like any financial market – your aim is to buy something cheaper and sell it dearer to make a profit.

What you do in a CFD trade is agree to exchange the difference in the value of an asset from one point in time to another. That is it. You don’t get physical ownership, nor dividends, nor company votes, CFDs give you price exposure. For many traders, that mechanism is part of the appeal.

What you do in a CFD trade is agree to exchange the difference in the value of an asset from one point in time to another. That is it. You don’t get physical ownership, nor dividends, nor company votes, CFDs give you price exposure. For many traders, that mechanism is part of the appeal.

CFD trading is a different animal to investing, which tends to focus on long-term ownership and gradual value growth. CFDs and forex in particular are often grouped together, since forex CFDs allow you to speculate on currency pairs like GBP/USD or EUR/JPY without exchanging actual currencies. Commodities and stock indices are the other two main asset classes besides forex used by CFD traders.

CFDs are typically traded through trading platforms offered by brokers, and positions can often be opened and closed within minutes, hours or days. This short-term day-trading nature is part of what separates CFD trading from investing. With investing, you usually buy the asset outright and hold it over time.

There is a steeper learning curve for CFD trading vs investing, not to mention higher risks – so keep reading to discover the main things to know.

CFDs are typically traded through trading platforms offered by brokers, and positions can often be opened and closed within minutes, hours or days. This short-term day-trading nature is part of what separates CFD trading from investing. With investing, you usually buy the asset outright and hold it over time.

There is a steeper learning curve for CFD trading vs investing, not to mention higher risks – so keep reading to discover the main things to know.

Main things to know about CFD trading

There is a lot of overlap between CFD trading vs investing vs options so here the focus is on some of the main things that differentiate it between these other ways to tackle the markets that you may or may not already be familiar with.

1. Leverage and margin

In most investing scenarios, you pay the full price of the asset and there is no chance of paying less upfront – not so with CFDs.

One of the most talked-about features in CFD trading (positively and negatively!) is the use of leverage. In simple terms, leverage allows you to control a larger position with a smaller upfront outlay, known as the margin.

For example, if a broker offers 10:1 leverage, you can open a position worth £1,000 with just £100 of your own funds.

One of the most talked-about features in CFD trading (positively and negatively!) is the use of leverage. In simple terms, leverage allows you to control a larger position with a smaller upfront outlay, known as the margin.

For example, if a broker offers 10:1 leverage, you can open a position worth £1,000 with just £100 of your own funds.

This can make CFD and forex trading seem more accessible, particularly for those with limited capital. However, leverage also amplifies risk. Gains are magnified, but so are losses (and it is possible to lose more than your initial margin). That is why managing risk is such an important part of trading CFDs or any other leveraged product.

Margin requirements vary depending on the asset class and the broker. For example, CFDs on forex often carry lower margin requirements than share CFDs, due to higher liquidity and tighter spreads.

Leverage can be useful for short-term traders looking to increase exposure but the downside is that it introduces complexity that doesn’t apply to traditional investing.

Margin requirements vary depending on the asset class and the broker. For example, CFDs on forex often carry lower margin requirements than share CFDs, due to higher liquidity and tighter spreads.

Leverage can be useful for short-term traders looking to increase exposure but the downside is that it introduces complexity that doesn’t apply to traditional investing.

2. Variety of markets

CFD trading provides access to multiple asset classes through a single platform. With a CFD account, it is possible to gain exposure to:

- Shares

- Indices

- Commodities

- Forex

Point being, you don’t need to login to multiple accounts or brokers to access these different asset classes.

This is particularly useful for traders who want to respond to short-term opportunities across different markets. For example, someone might trade forex CFDs during the London or New York sessions, then switch to stock market indices when company news is driving volatility. Others may focus on commodities such as oil or gold, especially during periods of economic uncertainty.

This is particularly useful for traders who want to respond to short-term opportunities across different markets. For example, someone might trade forex CFDs during the London or New York sessions, then switch to stock market indices when company news is driving volatility. Others may focus on commodities such as oil or gold, especially during periods of economic uncertainty.

3. Short selling vs Long buying

Going long means speculating that the price of an asset will rise, while going short involves speculating that it will fall. With CFDs, both positions are integrated into the platform and can typically be opened or closed with just a few clicks.

This flexibility used to be a key reason some traders prefer CFDs and forex over conventional buy-and-hold investing. For example, if negative news is released about a company, a trader might open a short position on a CFD in that company's stock, aiming to benefit from the expected price drop.

These days, short-selling is no longer limited to experienced traders or complex setups. Thanks to modern investing apps like Trading 212, the process has become more accessible, including the ability to take short positions on stocks and ETFs directly through a user-friendly platform.

Traditionally, short-selling involves borrowing shares, paying additional fees, and navigating more technical steps behind the scenes. With CFDs, the process is streamlined because you are not trading the underlying asset itself, but speculating on its price movement instead.

That said, CFD trading still comes with important considerations, including potential tax implications. Just because you are not buying or selling the actual asset doesn’t mean your trades are exempt from taxation, and you should always understand how local tax rules apply to your trading activity.

NOTE: Short positions are theoretically much more risky than long ones because a market can move up unlimited but can only go down to zero.

This flexibility used to be a key reason some traders prefer CFDs and forex over conventional buy-and-hold investing. For example, if negative news is released about a company, a trader might open a short position on a CFD in that company's stock, aiming to benefit from the expected price drop.

These days, short-selling is no longer limited to experienced traders or complex setups. Thanks to modern investing apps like Trading 212, the process has become more accessible, including the ability to take short positions on stocks and ETFs directly through a user-friendly platform.

Traditionally, short-selling involves borrowing shares, paying additional fees, and navigating more technical steps behind the scenes. With CFDs, the process is streamlined because you are not trading the underlying asset itself, but speculating on its price movement instead.

That said, CFD trading still comes with important considerations, including potential tax implications. Just because you are not buying or selling the actual asset doesn’t mean your trades are exempt from taxation, and you should always understand how local tax rules apply to your trading activity.

NOTE: Short positions are theoretically much more risky than long ones because a market can move up unlimited but can only go down to zero.

Pros of CFD trading

CFD trading offers a flexible way to speculate on a wide range of markets with features like leverage, short selling, and fast order execution. It appeals to traders looking for more direct and accessible exposure without the need to own the underlying assets. Of course, there are downsides too – we will cover them next.

Flexibility and accessibility

Most brokers offer user-friendly platforms where traders can open positions in global markets from their phone or laptop. There is no need for large amounts of capital to get started with very small minimum deposits required e.g. Trading 212 has low transaction minimums depending on your country of residence.

Because CFD trading operates across many asset classes it suits traders who want to respond to different market conditions quickly, all from a single account. For many, this convenience is a significant draw compared to managing multiple portfolios or accounts to gain the same level of market access.

Because CFD trading operates across many asset classes it suits traders who want to respond to different market conditions quickly, all from a single account. For many, this convenience is a significant draw compared to managing multiple portfolios or accounts to gain the same level of market access.

Potential return

First off, the opportunity for a high return always comes with taking a proportionately higher risk, hence the importance of risk management when trading CFDs.

No ownership of underlying assets

As already mentioned several times, when you trade CFDs, you are not buying the asset itself. You are entering into a contract that reflects the price change of that asset over time. That means:

- No stamp duty on UK share CFDs*

- No handling of physical commodities

- No need to convert currencies when trading forex CFDs

- No need to open separate accounts for different asset classes

- No concerns over custody or transfer of shares

- No waiting periods for settlement

This structure removes many of the practical hurdles to jump that come with ownership. Everything is handled through the CFD platform.

*Tax treatments depend on the individual circumstances of each person and might be subject to change in the future.

*Tax treatments depend on the individual circumstances of each person and might be subject to change in the future.

Cons of CFD trading

So CFD trading clearly offers flexibility and access but every CFD trader MUST understand that it also comes with notable risks. Leverage, fees, and market volatility can lead to significant losses, and the learning curve can be steep for beginners.

High risk and volatility

Leverage adds volatility – that is what you need to understand in three words.

This is even the case in forex markets, where a 2% daily change in exchange rates is considered an unusually large price swing but applies even more so in inherently volatile markets like commodities or growth stocks.

Let’s explore how this is the case:

This is even the case in forex markets, where a 2% daily change in exchange rates is considered an unusually large price swing but applies even more so in inherently volatile markets like commodities or growth stocks.

Let’s explore how this is the case:

EXAMPLE

Let’s say you are trading a CFD on a stock market index, such as the FTSE 100, with a total position size of £100,000.

Without leverage, if the index falls by 2%, your position would lose £2,000 — a 2% decline in both the market and your capital.

With 10:1 leverage, you might have only put up £10,000 to control that £100,000 position. The same 2% market move still results in a £2,000 loss — but this time, that is 20% of your capital.

Do you see how the amount is the same, but the percentage of your capital that you have risked is 10x higher?

This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

Without leverage, if the index falls by 2%, your position would lose £2,000 — a 2% decline in both the market and your capital.

With 10:1 leverage, you might have only put up £10,000 to control that £100,000 position. The same 2% market move still results in a £2,000 loss — but this time, that is 20% of your capital.

Do you see how the amount is the same, but the percentage of your capital that you have risked is 10x higher?

This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

For traders using leverage, this increased price sensitivity can lead to sharp changes in account balance within a short space of time. This differs from long-term investing, where temporary swings are often less significant to the overall strategy.

CFD and forex trading also involve fast-paced decision-making. Market reactions to economic data, central bank announcements or geopolitical events can be immediate. That is why understanding the relationship between volatility and leverage is essential before trading CFDs.

CFD and forex trading also involve fast-paced decision-making. Market reactions to economic data, central bank announcements or geopolitical events can be immediate. That is why understanding the relationship between volatility and leverage is essential before trading CFDs.

Costs and fees

Both CFD trading and traditional share investing come with some common costs.

The spread, which is the difference between the buy and sell price, applies in both cases — though it is typically more visible when trading CFDs. CFD brokers usually profit by widening the raw market spread.

Where the differences start to show is in the ongoing charges. With share CFDs, you are usually charged overnight financing fees if you hold a position open beyond the trading day. These can accumulate quickly, especially for longer trades. Active traders might also notice costs add up over time through repeated entries and exits.

When you invest in shares directly, there is normally a one-off fee when buying or selling, and no overnight charges. You may also receive dividends if the company pays them. With CFDs, dividend adjustments are sometimes applied, but since you don’t own the asset, they are not treated in the same way.

The spread, which is the difference between the buy and sell price, applies in both cases — though it is typically more visible when trading CFDs. CFD brokers usually profit by widening the raw market spread.

Where the differences start to show is in the ongoing charges. With share CFDs, you are usually charged overnight financing fees if you hold a position open beyond the trading day. These can accumulate quickly, especially for longer trades. Active traders might also notice costs add up over time through repeated entries and exits.

When you invest in shares directly, there is normally a one-off fee when buying or selling, and no overnight charges. You may also receive dividends if the company pays them. With CFDs, dividend adjustments are sometimes applied, but since you don’t own the asset, they are not treated in the same way.

Complexity and learning curve

At first glance, CFD trading can appear simple. You choose a market, decide whether you think it will rise or fall, and place your trade. Easy as that! But underneath that, there is a level of complexity that often takes time to fully understand.

Trading with leverage, especially, takes getting familiar with margin requirements, position sizing, and the potential for losses that exceed your initial outlay. When short term trading with CFDs, the pace can be difficult for newer traders to keep up with.

By contrast, long-term investing typically involves less frequent decisions and doesn’t require you to monitor price movements as closely. That doesn’t mean it is risk-free, but it can be more forgiving over time.

Trading with leverage, especially, takes getting familiar with margin requirements, position sizing, and the potential for losses that exceed your initial outlay. When short term trading with CFDs, the pace can be difficult for newer traders to keep up with.

By contrast, long-term investing typically involves less frequent decisions and doesn’t require you to monitor price movements as closely. That doesn’t mean it is risk-free, but it can be more forgiving over time.

What is Investing?

In this second section of the article, the focus turns to investing, what it is and how it compares to CFDs, forex trading and options trading.

Definition of investing

Investing is the act of allocating money into assets with the aim of generating a return over time.

This can involve buying shares in a company, holding bonds issued by governments or corporations, purchasing property, or using funds that group various assets together.

This can involve buying shares in a company, holding bonds issued by governments or corporations, purchasing property, or using funds that group various assets together.

The key difference between investing and CFD or forex trading is ownership. When you invest, you own the underlying asset. With CFDs, you are only speculating on price movements without taking ownership.

How does investing compare to trading?

When you invest, you are buying assets with the aim of growing your money over time. This can include shares, bonds, property or investment funds.

The approach is more passive and tends to focus on steady returns, income, or both. Costs are typically lower over time and don't involve leverage in the same way.

The approach is more passive and tends to focus on steady returns, income, or both. Costs are typically lower over time and don't involve leverage in the same way.

Main things to know about investments

Again, there are some common features to investing vs forex vs CFDs vs options, so this is about the stand-out features exclusive to investing.

Types of investments

Some common types of investments used by long-term investors are:

These are commonly used in long-term investing, but some are also accessible through CFD trading or options trading, depending on the approach taken.

- Stocks are perhaps the most familiar. Buying shares means owning a portion of a company, which may offer dividends and potential for capital growth. You can also trade share CFDs, which mirror the price of the stock without providing ownership.

- Bonds are fixed-income products, typically offering more stable returns. They are generally used in investing, not trading, although some platforms offer bond CFDs.

- Real estate (known as property in the UK) often involves buying physical property, but some traders use REITs or property-based ETFs to gain exposure without direct ownership.

- Commodities like gold or oil are available in both investing and CFD trading, with the key difference being whether you are buying for long-term value or trading short-term movements.

- Mutual funds and ETFs offer instant diversification, while alternative investments (such as private equity or hedge funds) are typically less accessible and longer term.

- Alternatives are usually less liquid and can’t be traded through a trading platform but this is not always the case. Classic cars and fine art might take longer to match a buyer and seller using an auction house but trading cards (e.g. Pokemon cards) can be readily bought and sold on eBay.

The distinction often comes down to the method. Many of the same asset classes exist in both investing and trading so what changes is the time horizon, level of risk, and whether ownership is involved.

Long-term perspective

Rather than trying to benefit from short-term price movements, the goal when investing is usually to build value gradually through time with the aid of compounding — where returns earned are reinvested to generate additional returns.

This could mean holding shares for several years, collecting dividends, or watching an asset appreciate over time.

Unlike forex or CFD trading, where a position might last a few days or even minutes, investing doesn’t typically require constant monitoring. Market ups and downs are part of the process, but short-term volatility is often less important than the broader market cycle.

This could mean holding shares for several years, collecting dividends, or watching an asset appreciate over time.

Unlike forex or CFD trading, where a position might last a few days or even minutes, investing doesn’t typically require constant monitoring. Market ups and downs are part of the process, but short-term volatility is often less important than the broader market cycle.

Ownership of assets

Unlike CFD or forex trading, investing is based on ownership, not speculation. It is usually done over a longer timeframe with a view to the long term appreciation in the value of the asset and decisions are not driven by short-term price movements.

Diversification

The idea of diversification is that if one investment performs poorly, others might perform well, helping to balance out your overall returns.

This might mean holding a mix of shares from different sectors, combining equities with bonds, or including property and international investments in your portfolio. Many investors use funds like ETFs to access diversified exposure through a single product.

With CFD trading, it is possible to trade different markets too like forex, indices, and commodities — but the short-term nature means you are really making a set of directional trades rather than building a balanced portfolio.

This might mean holding a mix of shares from different sectors, combining equities with bonds, or including property and international investments in your portfolio. Many investors use funds like ETFs to access diversified exposure through a single product.

With CFD trading, it is possible to trade different markets too like forex, indices, and commodities — but the short-term nature means you are really making a set of directional trades rather than building a balanced portfolio.

Pros of investing

Returns from investing take time to build so the approach offers more stability, compounding potential, and fewer short-term pressures than CFD or forex trading. It suits those with longer financial goals like paying for university fees or retirement planning.

Potential for steady returns

By holding a mix of assets (like those mentioned above) investors can aim to grow their wealth gradually without needing to respond to daily price movements. This approach may appeal to investors who prioritise long-term growth over frequent trading or attempts to time the market.

- | 💰 Saving | 📈 Investing |

Purpose | Preserve money for short-term needs | Potentially grow wealth over the long term |

Risk level | Very low (almost no risk) | Medium to high (market fluctuations) |

Returns | Generally low | Potentially higher, but not guaranteed |

Liquidity | High (easy access in savings accounts) | Varies (some assets can be harder to sell) |

Inflation impact | Money may lose value over time | Has the potential to outpace inflation |

Tools | Bank savings, fixed deposits | Stocks, ETFs, mutual funds, bonds, real estate |

EXAMPLE

Let’s imagine you have £5,000 that you don’t need to use right away. You are considering two options: putting it in a savings account or investing it.

💰 If you choose to save the money:

You put the £5,000 in a savings account that gives you 1.5% interest each year. After 10 years, your money will have grown slowly and safely to about £5,802. That is a gain of £802 over the decade. It is very low-risk – you won’t lose money, but you also won’t earn much.

📈 If you choose to invest the money:

You decide to invest the £5,000 in the stock market, where the average return is around 7% per year. If things go well, after 10 years your money could grow to about £9,835. That is a gain of £4,83 – much higher than saving. Of course, investing comes with risk, since the market can go up and down.

🧠 In short:

Saving is safer but grows slowly.

Investing has historically delivered higher returns over the long term compared to saving, although it involves greater risk and fluctuations in value.

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

💰 If you choose to save the money:

You put the £5,000 in a savings account that gives you 1.5% interest each year. After 10 years, your money will have grown slowly and safely to about £5,802. That is a gain of £802 over the decade. It is very low-risk – you won’t lose money, but you also won’t earn much.

📈 If you choose to invest the money:

You decide to invest the £5,000 in the stock market, where the average return is around 7% per year. If things go well, after 10 years your money could grow to about £9,835. That is a gain of £4,83 – much higher than saving. Of course, investing comes with risk, since the market can go up and down.

🧠 In short:

Saving is safer but grows slowly.

Investing has historically delivered higher returns over the long term compared to saving, although it involves greater risk and fluctuations in value.

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

Unlike CFD trading, which often relies on short-term changes in market direction, investing is generally based on the belief that quality assets will increase in value over time so the main goal is seeking out high quality vs low quality stocks. Even if markets go through ups and downs, many investors choose to buy and hold through periods of volatility with the expectation that it will all work out in the end.

Passive income opportunities

Passive income can come from dividends paid by companies to shareholders, interest from bonds, or income generated by investment funds.

With CFDs and most forex trading, there is no passive income. Instead, traders rely entirely on price movements to generate returns. If the market doesn’t move in the desired direction, there is no return and in fact, there will probably be a loss!

With CFDs and most forex trading, there is no passive income. Instead, traders rely entirely on price movements to generate returns. If the market doesn’t move in the desired direction, there is no return and in fact, there will probably be a loss!

Compounding benefits

Compounding in investing refers to reinvesting the passive earnings mentioned above so they can generate additional returns over time. The effect builds gradually but can lead to significant growth, especially when investments are held for many years. It is one of the key advantages of a long-term approach, where time in the market plays a central role.

In CFD and forex trading, compounding works a bit differently. Since profits are typically realised, traders often aim to grow their account balance in order to increase position sizes over time. This can lead to larger profits on the same style of trading but also greater risk exposure.

In CFD and forex trading, compounding works a bit differently. Since profits are typically realised, traders often aim to grow their account balance in order to increase position sizes over time. This can lead to larger profits on the same style of trading but also greater risk exposure.

Cons of investing

They say patience is a virtue and nowhere is that more the case than when investing! The difficulty comes from waiting for the returns to appear over the long term.

Investors have to avoid the temptation to rush into buying highly priced assets or getting spooked into selling assets after big price declines.

Investors have to avoid the temptation to rush into buying highly priced assets or getting spooked into selling assets after big price declines.

Time commitment

Researching assets, understanding company performance, and keeping up with economic trends all take effort, particularly for those managing their own portfolios.

Investing also tends to be a longer-term commitment. Results are not immediate, and it can take years to see the full impact of compounding or capital growth. For those expecting quick outcomes, this slower pace may feel frustrating.

Investing also tends to be a longer-term commitment. Results are not immediate, and it can take years to see the full impact of compounding or capital growth. For those expecting quick outcomes, this slower pace may feel frustrating.

Market fluctuations

Even the most stable companies or diversified funds can lose value due to broader market conditions, economic events or shifts in investor sentiment. You are always having to ask yourself – Is this price drop temporary or a structural change in the trend?

Unlike CFD trading, which can allow traders to take short positions and potentially benefit from falling prices, investing typically focuses on upward growth. That means holding through downturns rather than trading around them, making them much harder to swallow!

Unlike CFD trading, which can allow traders to take short positions and potentially benefit from falling prices, investing typically focuses on upward growth. That means holding through downturns rather than trading around them, making them much harder to swallow!

Emotional factors

Emotions can influence financial decisions — and investing is no exception. Watching the value of your portfolio fall during a market downturn can prompt panic selling. Likewise, a strong run in prices may tempt some to buy in at the top. These emotional reactions can be damaging to long-term performance.

The chart below shows the swings in human emotions that the crowd of investors go through through each market cycle.

The chart below shows the swings in human emotions that the crowd of investors go through through each market cycle.

The ability to stay disciplined and stick to a plan is important, but not always easy. Emotional decision-making doesn’t just affect new investors, even experienced ones can be influenced by fear and greed.

If you have a long term investment horizon, developing a steady mindset is par for the course, and for most people, this takes as much practice as the investment decisions themselves!

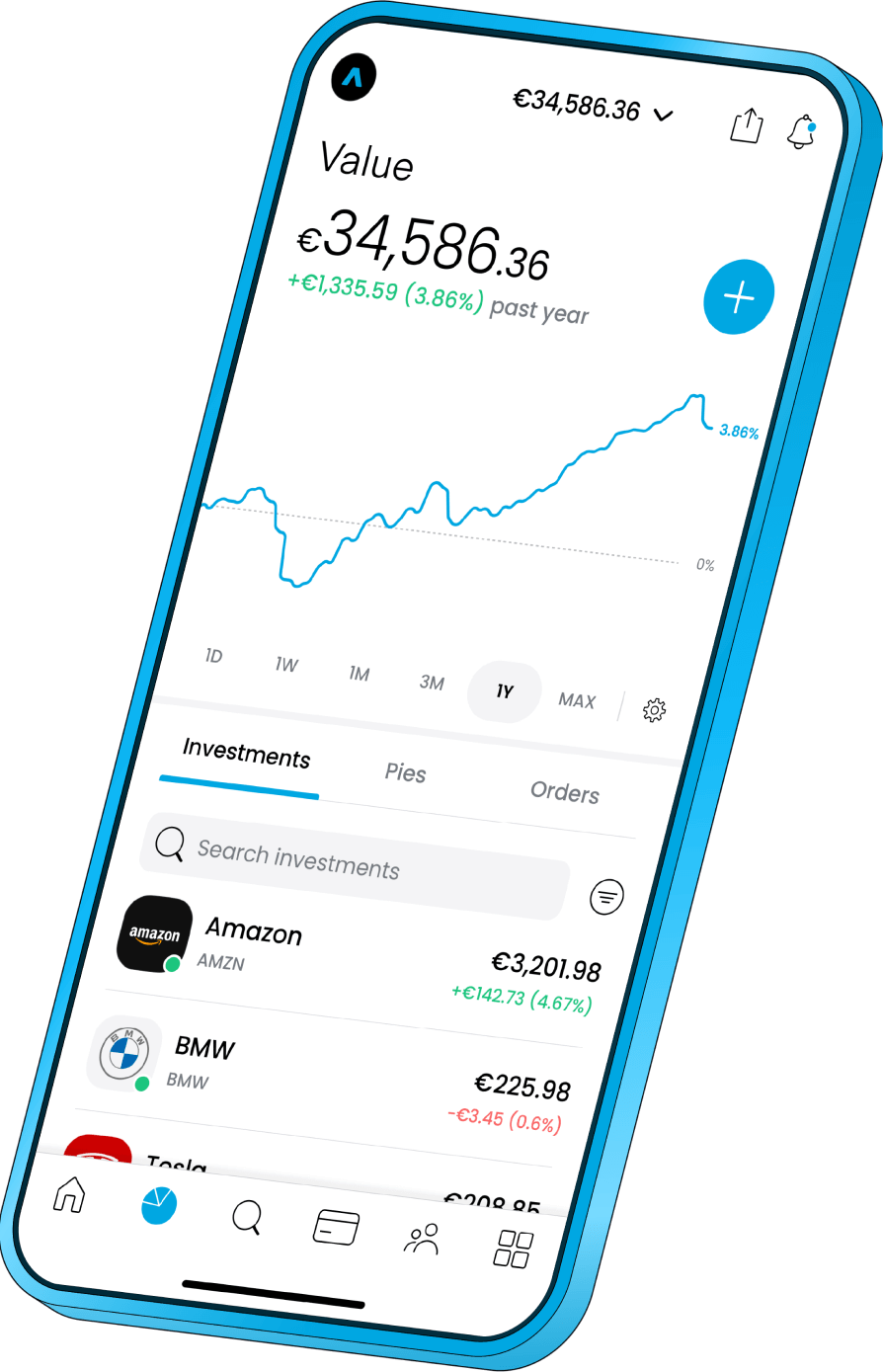

If you are considering investing in shares or ETFs, it is important to choose a platform that fits your needs and to review its terms, fees, and overall suitability. Trading 212, for example, offers access to thousands of global instruments that can be managed directly from your phone or computer.

If you have a long term investment horizon, developing a steady mindset is par for the course, and for most people, this takes as much practice as the investment decisions themselves!

If you are considering investing in shares or ETFs, it is important to choose a platform that fits your needs and to review its terms, fees, and overall suitability. Trading 212, for example, offers access to thousands of global instruments that can be managed directly from your phone or computer.

What is Forex trading?

Now we turn to the forex market and the opportunities it affords when contrasted with investing, CFDs or options trading.

Definition of forex trading

Forex trading is about trading in the foreign exchange market, speculating on the change in exchange rates between pairs of currencies.

How Forex trading works

Trading forex (or trading FX as it is sometimes referred to) is fundamentally the same as trading any other market. Just that instead of trading stocks or ETFs etc, you are trading exchange rates.

Trading an exchange rate is not as intuitive as investing in a company’s stock or a tangible asset like property. You are dealing with two currencies at once, which means you are buying one while simultaneously selling the other.

That might sound difficult at first, but in practice, you trade through a forex broker platform that displays live prices for each currency pair. You then decide whether you expect the exchange rate to move up or down, based on your analysis or strategy.

Trading an exchange rate is not as intuitive as investing in a company’s stock or a tangible asset like property. You are dealing with two currencies at once, which means you are buying one while simultaneously selling the other.

That might sound difficult at first, but in practice, you trade through a forex broker platform that displays live prices for each currency pair. You then decide whether you expect the exchange rate to move up or down, based on your analysis or strategy.

Main things to know about Forex trading

Forex trading focuses purely on currency pairs, unlike CFD trading, which covers a wider range of markets. You are speculating on how one currency moves against another — not owning the currencies, just trading on price movements.

It is different from investing, where the aim is long-term growth through asset ownership. Forex is short-term, fast-moving, and often uses leverage to trade large positions with less capital.

Here are some specific qualities of trading forex:

It is different from investing, where the aim is long-term growth through asset ownership. Forex is short-term, fast-moving, and often uses leverage to trade large positions with less capital.

Here are some specific qualities of trading forex:

1. Currency pairs

Each pair represents the exchange rate between two currencies — one being bought, the other sold.

For example, in GBP/USD, the first currency (GBP) is the base currency, and the second (USD) is the quote currency.

For example, in GBP/USD, the first currency (GBP) is the base currency, and the second (USD) is the quote currency.

Source: Trading 212. Past performance is no guarantee of future results. This information is not investment advice. Do your own research.

Source: Trading 212. Past performance is no guarantee of future results. This information is not investment advice. Do your own research.If you think the pound will rise against the dollar, you buy the pair.

If you think it will fall, you sell it.

Popular forex pairs include EUR/USD, USD/JPY, and GBP/USD. These are known as major pairs, and they tend to have high liquidity and tighter spreads.

There are also minor and exotic pairs, which involve currencies from smaller or emerging economies. These pairs can offer more volatility, but often come with wider spreads and lower trading volume.

You can find them all listed on the Trading 212 list of available forex pairs.

If you think it will fall, you sell it.

Popular forex pairs include EUR/USD, USD/JPY, and GBP/USD. These are known as major pairs, and they tend to have high liquidity and tighter spreads.

There are also minor and exotic pairs, which involve currencies from smaller or emerging economies. These pairs can offer more volatility, but often come with wider spreads and lower trading volume.

You can find them all listed on the Trading 212 list of available forex pairs.

2. Market availability

One of the main appeals of forex trading is that the forex market is open 24 hours a day, 5 days a week. Unlike stock and bond markets (the main venues for investing), which operate during specific local hours, the forex market moves continuously as trading sessions roll across major financial centres from Sydney to Tokyo to London to New York.

Wherever you live in the world, there is a currency pair that is most active when you are available to trade! It also suits those who prefer to trade outside standard working hours.

This round-the-clock availability means traders can respond to market events as they happen, without having to wait for an exchange to open.

Wherever you live in the world, there is a currency pair that is most active when you are available to trade! It also suits those who prefer to trade outside standard working hours.

This round-the-clock availability means traders can respond to market events as they happen, without having to wait for an exchange to open.

3. Speculation on price movements

Forex is often traded using CFDs, which means you are not exchanging the actual currencies — just speculating on the price movement. As such, much of what we discussed about CFDs applies to forex too.

You are not buying currencies to hold, as you would with an investment. The aim is to profit from changes in the price of a currency pair.

You are not buying currencies to hold, as you would with an investment. The aim is to profit from changes in the price of a currency pair.

4. Macro trading

Forex traders fall into a broader category known as macro traders, short for macroeconomics. As an FX trader you are speculating based on broad macroeconomic themes like interest rate decisions, inflation data, employment figures, and broader market sentiment.

The best macro traders don’t usually try to predict changes in the economy by economic forecasting. Instead, they look for discrepancies between how markets are currently pricing economic expectations and what’s actually happening on the ground. For example, if a central bank is sounding cautious but inflation data is running hot, that gap may create a trading opportunity.

This approach is not about predicting the future with precision, it is about recognising where sentiment or positioning may be out of sync with reality, and positioning accordingly.

The best macro traders don’t usually try to predict changes in the economy by economic forecasting. Instead, they look for discrepancies between how markets are currently pricing economic expectations and what’s actually happening on the ground. For example, if a central bank is sounding cautious but inflation data is running hot, that gap may create a trading opportunity.

This approach is not about predicting the future with precision, it is about recognising where sentiment or positioning may be out of sync with reality, and positioning accordingly.

Pros of Forex trading

Forex trading offers high liquidity, around-the-clock access, and the ability to speculate in both directions. With relatively low costs and flexible position sizes, it attracts traders looking for active, short-term opportunities from anywhere in the world.

High liquidity

The forex market sees trillions in daily turnover, making it far more liquid than most stock or bond markets. Major pairs like EUR/USD and GBP/USD trade heavily around the clock, which allows positions to be opened and closed quickly, often with tight spreads and minimal slippage.

Source: Bank for International Settlements Triennial Surveys

Source: Bank for International Settlements Triennial SurveysCompared to investing, where large positions in shares or funds might take longer to fill, forex is more agile. And while CFD trading also offers access to liquid markets, not all CFD instruments match the volume and depth seen in the major currency pairs.

Leverage

Most investors pay the full value of the asset upfront and are not exposed to margin calls or the risk of losses exceeding their initial outlay.

Forex trading is commonly associated with the use of leverage, which allows traders to control larger positions with a relatively small deposit. For example, with 30:1 leverage, a £1,000 margin could give you exposure to a £30,000 position in a major currency pair.

Like in our CFD example, using high leverage results in a larger percentage swings in your capital. A £1000 loss on a £30,000 trade with no leverage is a loss of 3.3%, but is a 100% loss of all capital if using 30:1 leverage.

Forex trading is commonly associated with the use of leverage, which allows traders to control larger positions with a relatively small deposit. For example, with 30:1 leverage, a £1,000 margin could give you exposure to a £30,000 position in a major currency pair.

Like in our CFD example, using high leverage results in a larger percentage swings in your capital. A £1000 loss on a £30,000 trade with no leverage is a loss of 3.3%, but is a 100% loss of all capital if using 30:1 leverage.

Diverse trading strategies

Forex trading allows for a wide range of strategies depending on time commitment, risk appetite and market conditions.

- Scalping is at the fast end where traders open and close multiple positions within minutes, looking for small price moves.

- Day trading involves holding positions for a few hours at most, closing all trades before the day ends.

- Swing trading spans several days or even weeks, aiming to catch short- to medium-term trends.

- Position trading takes a longer view, holding trades for weeks or months based on broader macroeconomic themes.

These styles are commonly used in forex and CFD trading, where speed, flexibility, and the ability to trade both long and short are the name of the game.

By contrast, investing aligns more closely with position trading. Investors generally hold assets like shares or bonds for long periods, aiming for value growth or income. While day trading stocks is possible, it requires a different mindset, higher capital, and is not typical of most long-term investors.

By contrast, investing aligns more closely with position trading. Investors generally hold assets like shares or bonds for long periods, aiming for value growth or income. While day trading stocks is possible, it requires a different mindset, higher capital, and is not typical of most long-term investors.

Low transaction costs

Most brokers charge no commission on forex trades, instead making their money through widening the spread. In liquid pairs, spreads can be very tight, keeping costs down for active traders.

Holding forex positions overnight also results in either paying or earnings the swap, a percentage rate calculated based on the interest rate differential between the two currencies in the pair.

Compared to share trading, where investors often pay a flat fee per transaction or a percentage-based commission, forex can be more cost-efficient, particularly for frequent trades. In CFD trading, fees vary by asset class, and overnight financing costs may apply. The same goes for options trading, where contracts may involve brokerage fees and more complex pricing.

Holding forex positions overnight also results in either paying or earnings the swap, a percentage rate calculated based on the interest rate differential between the two currencies in the pair.

Compared to share trading, where investors often pay a flat fee per transaction or a percentage-based commission, forex can be more cost-efficient, particularly for frequent trades. In CFD trading, fees vary by asset class, and overnight financing costs may apply. The same goes for options trading, where contracts may involve brokerage fees and more complex pricing.

Cons of Forex trading

Despite its broad popularity, forex trading definitely has some drawbacks that traders need to know and accept before undertaking it.

Market complexity

For new traders, understanding what is driving a currency pair can be challenging.

Economists are constantly getting the economy wrong so what hope do forex traders have? Compared to CFD trading on single stocks or indices, forex even involves analysing two economies at once.

Unlike investing, where the focus is often on company fundamentals or long-term trends, forex trading requires constant awareness of short-term economic data and global news. Currency prices can react within seconds to announcements like interest rate decisions or inflation figures.

Economists are constantly getting the economy wrong so what hope do forex traders have? Compared to CFD trading on single stocks or indices, forex even involves analysing two economies at once.

Unlike investing, where the focus is often on company fundamentals or long-term trends, forex trading requires constant awareness of short-term economic data and global news. Currency prices can react within seconds to announcements like interest rate decisions or inflation figures.

Risk of losses

At this point we need to again harp on the additional risk associated with using leverage. It is a point that should be laboured! A relatively small move in a currency pair when trading larger positions can lead to a significant impact on your account balance.

Unlike traditional investing, where you generally can’t lose more than your original capital, leveraged forex and CFD trading carries the risk of magnified losses.

Tools like stop-loss orders can help limit downside but nothing can eliminate risk entirely — especially in fast-moving markets or during periods of low liquidity.

Unlike traditional investing, where you generally can’t lose more than your original capital, leveraged forex and CFD trading carries the risk of magnified losses.

Tools like stop-loss orders can help limit downside but nothing can eliminate risk entirely — especially in fast-moving markets or during periods of low liquidity.

Regulatory considerations

Forex and CFD trading are regulated activities in the UK and must be offered by firms authorised by the Financial Conduct Authority (FCA). These rules are designed to protect retail clients through measures such as leverage limits, mandatory risk warnings, and negative balance protection.

Compared to traditional investing, the regulatory framework for trading places greater emphasis on risk management and transparency, rather than investor rights or direct asset protection.

In Australia, forex and CFD brokers are regulated by the Australian Securities and Investments Commission (ASIC). ASIC imposes restrictions on leverage, enforces negative balance protection, and prohibits incentives that may encourage excessive risk-taking.

In Cyprus, brokers fall under the oversight of the Cyprus Securities and Exchange Commission (CySEC). As part of the EU, CySEC follows MiFID II regulations, requiring firms to maintain client fund segregation, offer transparent pricing, and apply investor protection measures.

In Germany, trading firms are supervised by BaFin, one of Europe’s most stringent financial regulators. BaFin ensures brokers meet strict standards for capital adequacy, risk disclosures, and fair treatment of retail clients.

Not all forex brokers are regulated in the UK or EU, so traders should be cautious when considering offshore providers. Checking for authorisation by a reputable regulator — such as the FCA, ASIC, CySEC, or BaFin — is a vital step in reducing counterparty risk and ensuring a secure trading environment.

If you would like to learn more about how the foreign exchange market works, visit our guide: What is Forex Trading and how does FX work.

Compared to traditional investing, the regulatory framework for trading places greater emphasis on risk management and transparency, rather than investor rights or direct asset protection.

In Australia, forex and CFD brokers are regulated by the Australian Securities and Investments Commission (ASIC). ASIC imposes restrictions on leverage, enforces negative balance protection, and prohibits incentives that may encourage excessive risk-taking.

In Cyprus, brokers fall under the oversight of the Cyprus Securities and Exchange Commission (CySEC). As part of the EU, CySEC follows MiFID II regulations, requiring firms to maintain client fund segregation, offer transparent pricing, and apply investor protection measures.

In Germany, trading firms are supervised by BaFin, one of Europe’s most stringent financial regulators. BaFin ensures brokers meet strict standards for capital adequacy, risk disclosures, and fair treatment of retail clients.

Not all forex brokers are regulated in the UK or EU, so traders should be cautious when considering offshore providers. Checking for authorisation by a reputable regulator — such as the FCA, ASIC, CySEC, or BaFin — is a vital step in reducing counterparty risk and ensuring a secure trading environment.

If you would like to learn more about how the foreign exchange market works, visit our guide: What is Forex Trading and how does FX work.

What is Options trading?

Possibly the most complicated and misunderstood of all the ways to engage with the markets, options have some unique qualities vs investing and forex/CFD trading.

DEFINITION OF OPTIONS TRADING

Options trading involves contracts that give you the right but not the obligation to buy or sell an asset at a specific price within a set time period.

Unlike investing, where you buy and hold an asset directly, options allow you to set defined risk and potential reward around a specific price and timeframe. A key difference from long-term investing is that options contracts have an expiry date, often monthly, meaning your position is time-limited.

And instead of speculating directly on price movements like CFD or forex trading, options are derivative instruments that involve the right, but not the obligation, to buy or sell the underlying asset at a set price before a certain date.

And instead of speculating directly on price movements like CFD or forex trading, options are derivative instruments that involve the right, but not the obligation, to buy or sell the underlying asset at a set price before a certain date.

The essentials of Options trading

An option is a contract linked to an underlying asset like individual shares, indices or futures contract. They are often used for speculation, hedging, or generating income through more advanced strategies.

Compared to investing, options trading is more complex and time-sensitive. The value of an option depends not only on the price of the underlying asset, but also on factors like volatility and time remaining before expiry. The most popular formula for pricing options is Black Scholes.

Options traders need to get comfortable with a few concepts that don’t apply in the same way to investing or CFD trading. Two of the most important are knowing whether an option is in-the-money (ITM) or out-of-the-money (OTM), and how the Greeks affect an option’s price.

Compared to investing, options trading is more complex and time-sensitive. The value of an option depends not only on the price of the underlying asset, but also on factors like volatility and time remaining before expiry. The most popular formula for pricing options is Black Scholes.

Options traders need to get comfortable with a few concepts that don’t apply in the same way to investing or CFD trading. Two of the most important are knowing whether an option is in-the-money (ITM) or out-of-the-money (OTM), and how the Greeks affect an option’s price.

In-the-Money vs Out-of-the-Money

An option is in the money if it has intrinsic value. For a call option, this means the market price is above the strike price. For a put option, it is the opposite — the market price is below the strike. Out of the money means there is no intrinsic value yet, but the option could still gain value before expiry.

In investing, you either hold the asset or you don’t and the closest concept to being in and out of the money is whether the asset is worth more or less than when you bought it. In CFD trading, profits and losses are immediate and linear based on price movement, without conditions like strike price or expiry.

In investing, you either hold the asset or you don’t and the closest concept to being in and out of the money is whether the asset is worth more or less than when you bought it. In CFD trading, profits and losses are immediate and linear based on price movement, without conditions like strike price or expiry.

The Greeks

The Greeks are tools that help option traders understand how different factors affect an option’s price. The key ones include:

- Delta – How much the option’s price moves relative to the underlying asset.

- Theta – The impact of time decay (options lose value as expiry nears).

- Vega – How sensitive the option is to changes in market volatility.

- Gamma – How much delta changes as the underlying price moves.

In contrast, forex and CFD traders typically focus on direction, price levels, and risk/reward — without needing to track the impact of time or volatility in the same structured way.

How to invest in options for beginners?

- To begin, you will need a trading platform that offers access to options markets. Some platforms may require additional approvals or checks to confirm that options are appropriate for your experience level.

- Beginners often start by buying call or put options, as this limits the maximum loss to the cost of the option (the premium). More advanced strategies such as spreads or selling options introduce additional risks and are best approached with a deeper understanding of how options behave.

- As you practice options trading strategies, key factors to consider include the strike price, expiry date, and market volatility — all of which affect the value of the option.

Types of options

There are two main types of options contracts used in trading: call options and put options. Each serves a different purpose depending on your view of the market and whether you want to speculate or manage risk.

In both cases, you are not buying or selling the asset itself but instead you are buying the right to do so under certain conditions.

In both cases, you are not buying or selling the asset itself but instead you are buying the right to do so under certain conditions.

What are call options?

DEFINITION OF CALL OPTIONS

A call option is used when a trader has a bullish view — they expect the price of an asset to rise.

Instead of buying the asset outright, as you would when investing, the trader buys a call option, which gives the right (but not the obligation) to buy the asset at a fixed price within a set timeframe.

Instead of buying the asset outright, as you would when investing, the trader buys a call option, which gives the right (but not the obligation) to buy the asset at a fixed price within a set timeframe.

This approach is different from investing because it uses less capital upfront and limits potential loss to the premium paid. If the price goes up beyond the strike price, the option gains value. If it doesn’t, the option can expire worthless — but your maximum loss is defined from the start.

For traders who are bullish but want controlled risk and exposure, calls provide a flexible way to express that view. Unlike CFD trading, where losses can exceed deposits if markets move quickly, call options come with clear risk boundaries, while still offering upside potential.

For traders who are bullish but want controlled risk and exposure, calls provide a flexible way to express that view. Unlike CFD trading, where losses can exceed deposits if markets move quickly, call options come with clear risk boundaries, while still offering upside potential.

What are put options?

DEFINITION OF PUT OPTIONS

A put option is typically used when a trader has a bearish outlook — expecting the price of an asset to fall.

Rather than shorting the asset through CFD trading, or simply avoiding it as an investor might, the trader buys a put option. This gives the right to sell the asset at a set price before expiry.

Rather than shorting the asset through CFD trading, or simply avoiding it as an investor might, the trader buys a put option. This gives the right to sell the asset at a set price before expiry.

It is a different mindset from investing, which usually involves owning assets and hoping they rise in value. A put allows traders to benefit from falling prices without the unlimited risk that can come with short-selling or leveraged trades.

In both cases, whether bearish or cautious, options trading with puts offers a defined-risk method to profit from or protect against falling markets — a structure not found in typical investing.

In both cases, whether bearish or cautious, options trading with puts offers a defined-risk method to profit from or protect against falling markets — a structure not found in typical investing.

What is leverage in Options trading?

Options trading provides built-in leverage, meaning you can gain exposure to a larger position using a smaller upfront cost called the premium. Instead of buying 100 shares of a stock outright, you could buy one option contract that controls those same shares for a fraction of the price.

EXAMPLE

Here is how it works:

One options contract typically controls 100 shares of the underlying asset.

So, if a share trades at £50, buying 100 shares outright would cost £5,000.

A call option on the same stock might cost £200 per contract.

That means you are controlling a £5,000 position for just £200 i.e. a 25:1 notional leverage.

But…

The actual impact of leverage depends on how far the option is from the strike price, time to expiry, and implied volatility.

Unlike CFDs, where margin requirements are clearly defined and consistent, options leverage varies by position and is influenced by how the option behaves (known as its delta).

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

One options contract typically controls 100 shares of the underlying asset.

So, if a share trades at £50, buying 100 shares outright would cost £5,000.

A call option on the same stock might cost £200 per contract.

That means you are controlling a £5,000 position for just £200 i.e. a 25:1 notional leverage.

But…

The actual impact of leverage depends on how far the option is from the strike price, time to expiry, and implied volatility.

Unlike CFDs, where margin requirements are clearly defined and consistent, options leverage varies by position and is influenced by how the option behaves (known as its delta).

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

This makes options similar to CFD and forex trading, where leverage allows traders to amplify potential returns (and losses). However, the key difference is that with options, your maximum loss is limited to the premium you paid — unlike leveraged CFDs, where losses can exceed your initial deposit.

How can you hedge with options?

Buying a put is also a way to hedge. For example, if you own shares but are concerned about a short-term drop, a put option can protect against losses, acting like insurance.

This chart illustrates a protective put strategy, where an investor holds a long stock position (bought at £100) and buys a put option with a £95 strike price to limit downside risk. The put acts as insurance — if the stock falls below £95, the losses are capped at £1,000 (reflecting the cost of the premium).

This chart illustrates a protective put strategy, where an investor holds a long stock position (bought at £100) and buys a put option with a £95 strike price to limit downside risk. The put acts as insurance — if the stock falls below £95, the losses are capped at £1,000 (reflecting the cost of the premium).

The break-even point is £105, meaning the stock must rise above this level to cover both the original stock cost and the option premium. Upside profit remains unlimited, while downside loss is limited, making this strategy useful for investors who want to stay in a position but reduce the impact of sharp declines.

What determines an option’s price?

The price of an option (which has a specific name in options trading parlance, which is the premium) is influenced by several moving parts. Unlike CFD trading or forex trading, where price is based purely on market movement, options trading involves both price and time factors.

Intrinsic value

This is the difference between the asset’s current market price and the strike price of the option. Only in the money options have intrinsic value.

FORMULA

Options intrinsic value

📈 For a call option:

Intrinsic value = Current market price of the asset − Strike price

If the result is negative, the intrinsic value is 0 (the option is out of the money).

📉 For a put option:

Intrinsic value = Strike price − Current market price of the asset

Again, if the result is negative, intrinsic value is 0.

📈 For a call option:

Intrinsic value = Current market price of the asset − Strike price

If the result is negative, the intrinsic value is 0 (the option is out of the money).

📉 For a put option:

Intrinsic value = Strike price − Current market price of the asset

Again, if the result is negative, intrinsic value is 0.

Time value

Options lose value as they get closer to expiry because there is less and less time to make money on the trade. On the flipside, the more time left, the more opportunity for the trade to become profitable — so the premium is higher.

Volatility

The more an asset’s price moves, the greater the chance it will pass the strike price. You have to pay for the privilege of that greater chance so higher volatility increases an option’s price.

Interest rates and dividends

Changes in interest rates and expected dividends (for share options) can influence option prices slightly, but they tend to have a smaller impact than time and volatility.

How to trade options: Steps for effective option trading

Follow these 5 steps before every options trade you take:

1. Select the market where you want to trade options

As mentioned already, options are available on a range of markets. Your choice will depend on what you are most familiar with, where you think there’s an opportunity and what suits your goals.

Forex or CFD trading ranges across multiple asset classes – both OTC and on an exchange – from a single platform but options trading is often tied to specific listed markets and regulated exchanges.

Forex or CFD trading ranges across multiple asset classes – both OTC and on an exchange – from a single platform but options trading is often tied to specific listed markets and regulated exchanges.

2. Take a view, are you bullish or bearish or neutral?

Before choosing an option strategy, decide on your market outlook. Do you expect the price to rise (bullish), fall (bearish), or stay within a certain range (neutral)? This is different from traditional investing, which usually assumes long-term growth.

3. Choose your strategy for options trading

We have already covered buying puts and calls to express bullish or bearish views.

For more neutral views where you don’t have a strong directional bias but expect higher volatility in either direction, options traders often use strategies like straddles, strangles, or iron condors. These can benefit from sharp moves in either direction or from mispriced volatility.

A straddle, for example, profits when the price moves far enough away from the strike either up or down to offset the combined cost of two premiums for the call and put. The pay-off as it pertains to a straddle vs the price of the underlying stock looks like this:

For more neutral views where you don’t have a strong directional bias but expect higher volatility in either direction, options traders often use strategies like straddles, strangles, or iron condors. These can benefit from sharp moves in either direction or from mispriced volatility.

A straddle, for example, profits when the price moves far enough away from the strike either up or down to offset the combined cost of two premiums for the call and put. The pay-off as it pertains to a straddle vs the price of the underlying stock looks like this:

You can also choose to sell options, which allows you to collect the premium upfront. Sellers are taking on more risk in exchange for limited potential gain. This approach is often used when a trader believes the option is unlikely to move into profit before expiry.

For example, selling a call when you believe a stock will remain below a certain level, or selling a put when you are comfortable buying the stock if it falls.

Unlike simply buying shares or entering a forex CFD, the market not only has to move in the right direction, but it needs to do so within a certain timeframe and by a certain amount. This layered structure gives options more flexibility, but also requires more planning and risk awareness.

For example, selling a call when you believe a stock will remain below a certain level, or selling a put when you are comfortable buying the stock if it falls.

Unlike simply buying shares or entering a forex CFD, the market not only has to move in the right direction, but it needs to do so within a certain timeframe and by a certain amount. This layered structure gives options more flexibility, but also requires more planning and risk awareness.

4. Decide the best time to get in, and place the trade

Timing matters in options trading, as time decay works against the buyer.

According to The Options Industry Council®, historically, over 70% of option contracts are closed before they reach expiry. Around 22% of options expire worthless, and only a small fraction (roughly 6%) are actually exercised.

Placing a trade too early can eat into the premium’s value, even if the market eventually moves in your favour. You will need to place the trade through a broker that supports the type of options you want to trade.

According to The Options Industry Council®, historically, over 70% of option contracts are closed before they reach expiry. Around 22% of options expire worthless, and only a small fraction (roughly 6%) are actually exercised.

Placing a trade too early can eat into the premium’s value, even if the market eventually moves in your favour. You will need to place the trade through a broker that supports the type of options you want to trade.

5. Monitor your current position before taking the next action

Options are not set and forget because market direction, volatility, and time to expiry all affect an option’s price. Unlike long-term investing, and more so than CFD trading, options positions often require monitoring and adjusting. Your choices are wider with what to do with your trade- you can, depending on how the trade is developing relative to your expectations:

- Choose to close early

- Roll to another expiry

- Let it expire

Pros of Options trading

Options trading offers detail and flexibility that many other financial instruments don’t, specifically:

- Many variations of strategies: Options allow traders to structure positions based on direction, size of movement, and time — offering more variety/selectivity than traditional investing or CFD trading.

- Maximum risk pre-defined (when buying): When you buy a call or put option, the most you can lose is the premium paid. This gives more clarity on risk compared to forex or CFD trading, where losses can exceed deposits.

- Use for hedging: Options can protect existing positions from downside risk. For example, buying a put option can limit losses without needing to sell a long-term investment.

- Selling as an income source: Selling options — such as covered calls or cash-secured puts — can be used to collect premium in sideways or slow-moving markets. This is an approach not easily available through standard investing.

- Extra buying power without borrowing: Options provide exposure to larger positions using less capital, without needing to borrow or use traditional margin.

Cons of Options trading

- More complex than other instruments: Options involve more variables than investing, CFD trading, or forex. Pricing depends on time to expiry, volatility, and how far the strike is from the current market price — not just direction.

- Time sensitivity: Time decay, which doesn’t happen with a regular investment, means options trades can lose value even if the underlying asset hasn’t moved much itself. And with expiry dates, the market must move in your favour within a set timeframe. This makes timing just as important as direction, especially when buying options.

- High risk (when selling options): Buying options is risky though the risk is limited but selling options to collect premium can expose traders to theoretically unlimited losses if the market moves sharply.

- Not that beginner-friendly: The added terminology and mechanics particularly the Greeks usually make options trading harder to grasp for those without a natural tendency for mathematics, new to financial markets or just used to more simple buy/sell decisions when investing.

Choosing the right approach

There are two parts to deciding which method of investing/trading the markets might be best.

- Learn what each type of trading/investing offers

- Match the right approach to your situation, goals and investment style

Part 1: Comparing CFDs vs Forex vs Investing vs Options

Each method carries a different balance of risk and return, time commitment and variety of strategies.

Risk and reward profiles

- Investing for the most part can involve less frequent decision-making and focuses on steady long-term growth. Risk is often lower on a per-position basis, so may suit those looking to build wealth gradually over time.

- CFD and Forex trading carry much higher risk because you are employing leverage. A small market move can translate into a proportionately much larger gain or loss relative to your deposit. That means the potential returns are higher but so are the chances of wiping out your capital completely, known as blowing up your account.

- Options trading sits somewhere in the middle. Buying options gives you defined risk, but the trade-off is that they can (and do) expire worthless. Selling options can add income on top of other trades but comes with added complexity and greater risk.

Potential returns

- Investing aims for gradual gains over the years, supported by dividends and compounding returns. It may not generate fast results but can deliver meaningful returns with time, patience, and discipline.

- CFD and Forex trading focus on short-term price movements. While there may be more frequent opportunities compared to long-term investing, this also means greater exposure to potential losses. Catching these moves is easier said than done and requires strong risk control, discipline, and a clear strategy. The same volatility that can create profit opportunities can just as easily work against you.

- Options trading allows for what is known as asymmetric payoffs i.e. a limited loss with higher upside potential. On top of that, certain strategies, like spreads or covered calls, can generate income in flat markets. However, depending on the strategy, losses can still occur and, in some cases, be significant. Similar to CFDs, options trading has the potential for big returns, but because of the fast price movements and high risk, it is not suitable for everyone.

Differences in time investment

- Investing tends to be hands-off, which some people like and others don’t. Once a portfolio is set, you might only check in occasionally to rebalance it a few times a year.

- CFD and Forex trading require far more day-to-day involvement. Many traders follow markets daily or hourly, especially when managing short-term positions or using technical analysis. You have really got to love it to dedicate this much time to trading.

- Options trading falls somewhere in between. Some strategies need active management, while others like simple hedges can be more set-and-forget.

Types of strategies employed

- Investing is pretty much long-only by nature. You buy and hold assets because you believe they will rise in value, or because they pay you an income over time. Strategies often focus on diversification, asset allocation, passive vs active investing, dividend growth, or indexing.

- CFD and Forex trading allow you to go both long and short the markets. You can trade around news, technical setups with thousands of different indicators to choose from, or macro themes. Strategies vary from scalping and day trading to longer-term trend following.

- Options trading adds even more variation. You can speculate on price moves, speculate on volatility, hedge existing positions, or generate income. Strategies include buying calls or puts, spreads, straddles, and selling options to collect premium.

Part 2: Assessing your financial goals

While all types of trading and investing have their pros and cons that you need to know and appreciate, the ultimate reason why you should decide one over the other is what you’re like, and what suits you.

Short-term vs long-term objectives

Before choosing a method, ask yourself what you are actually aiming to do, as in what is all this in aid of? Are you looking to build long-term wealth, or are you more interested in short-term trading opportunities?

If you are looking to make a quick buck, it is time for a reality-check. While some individuals may achieve success in day trading, it is a high-risk activity that requires extensive experience, discipline, and a strong understanding of the markets.Conversely investing has worked for a lot of investors but it might take years if not decades to bear fruit.

If your goal is to grow your money steadily over time, with limited day-to-day involvement, investing in shares, bonds, or funds may be more suitable. If you are more focused on capitalising on short-term moves whether it is in currencies, indices, or individual stocks then CFD trading, forex, or options trading might suit better.

If you are looking to make a quick buck, it is time for a reality-check. While some individuals may achieve success in day trading, it is a high-risk activity that requires extensive experience, discipline, and a strong understanding of the markets.Conversely investing has worked for a lot of investors but it might take years if not decades to bear fruit.

If your goal is to grow your money steadily over time, with limited day-to-day involvement, investing in shares, bonds, or funds may be more suitable. If you are more focused on capitalising on short-term moves whether it is in currencies, indices, or individual stocks then CFD trading, forex, or options trading might suit better.

Personal risk tolerance

It is tempting to never try to understand your own comfort with risk but not doing so sows the seeds to failure. Don’t kid yourself – of course every method involves risk, but how much are you ACTUALLY willing (or able) to take?

- Investing generally involves lower short-term risk, especially when diversified and held for the long term. Price fluctuations happen so you’ll see drawdowns in your capital from peaks to troughs but there's no leverage involved so the risk of forced losses is reduced.