CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is Forex Trading and how does FX work? From beginner concepts to advanced strategies

You probably already know that forex is about exchanging currencies, but do you know the deeper details that shape daily currency market swings? The kind of swings that forex traders aim to profit from? This article closes that gap.

QUOTE

A system of floating exchange rates is not only feasible but is the best arrangement for an international monetary system.

Big ideas

- The forex market is the world’s largest and most liquid financial market, with an average daily turnover easily surpassing that of all global stock markets put together.

- The US Dollar is what is called the global reserve currency, meaning its interest rates and economic data tend to reverberate across all other exchange rates.

- Because trading takes place around the clock (24-hour trading) on weekdays, the forex market is commonly segmented into regional sessions. They are the Asian, European, and North American sessions.

- Small price increments known as pips play a central role in measuring profit and loss by forex traders; even marginal shifts can significantly impact trading outcomes when leverage is used via a CFD or a spot forex contract.

What is Forex (Foreign Exchange Trading)?

DEFINITION OF FOREX

Foreign exchange, often referred to as forex or FX, involves exchanging one currency for another at a negotiated rate.

You will encounter a version of this when you pop by a foreign exchange desk, maybe at the airport, to change pounds into another currency before a holiday. What you are doing there is foreign exchange i.e. forex.

Source: Dublin Airport

Source: Dublin AirportIn reality, the bulk of foreign exchange transactions happen between large international banks who are transacting on behalf of institutions, like multinational corporations or pension funds.

You might have been searching terms like forex trading basics or beginner currency trading to learn the process of buying and selling different currency pairs on an electronic platform. Don’t worry – we will get to the more specific concept of foreign exchange trading shortly. If you already think you know what forex is and want to get to forex trading, just skip ahead.

You might have been searching terms like forex trading basics or beginner currency trading to learn the process of buying and selling different currency pairs on an electronic platform. Don’t worry – we will get to the more specific concept of foreign exchange trading shortly. If you already think you know what forex is and want to get to forex trading, just skip ahead.

How Forex works

The foreign exchange market, or forex, is where currencies are exchanged at constantly shifting (or floating) rates.

EXAMPLE

Let’s go back to the idea of standing at the foreign exchange desk at an airport — forex is essentially this, just on a much larger scale.

For example, if you were travelling from London to New York and exchanged £1,000 for US dollars, you’d receive a certain exchange rate for British pounds into US dollars. This is written as GBP/USD.

Let’s say the GBP/USD exchange rate is 1.30, meaning you’d get 1.30 US dollars for every 1 British pound. So, for £1,000, you’d receive $1,300.

Now imagine that by the time you return to the UK, the pound has weakened against the dollar and the exchange rate is now 1.20. When you convert your $1,300 back into pounds, you’d get around £1,083 — a neat little profit of £83, assuming you didn’t spend any of your dollars while abroad.

For example, if you were travelling from London to New York and exchanged £1,000 for US dollars, you’d receive a certain exchange rate for British pounds into US dollars. This is written as GBP/USD.

Let’s say the GBP/USD exchange rate is 1.30, meaning you’d get 1.30 US dollars for every 1 British pound. So, for £1,000, you’d receive $1,300.

Now imagine that by the time you return to the UK, the pound has weakened against the dollar and the exchange rate is now 1.20. When you convert your $1,300 back into pounds, you’d get around £1,083 — a neat little profit of £83, assuming you didn’t spend any of your dollars while abroad.

On a larger scale, multinational companies and financial institutions deal with these fluctuations daily, managing billions in currency transactions. And forex traders do this same kind of transaction (except usually in large amounts) via forex software or forex apps called forex trading platforms.

Understanding the Forex market

The forex market is the largest financial market in the world. Its sheer size means that major currency pairs, such as GBP/USD and EUR/USD, are highly liquid so they can be bought and sold with minimal price disruption.

Most forex trading takes place in a few key financial hubs, with London, New York, and Tokyo handling the bulk of daily transactions. These are known as the three forex trading sessions.

Most forex trading takes place in a few key financial hubs, with London, New York, and Tokyo handling the bulk of daily transactions. These are known as the three forex trading sessions.

London, in particular, plays a central role, processing a significant portion of global forex activity. The market includes both spot transactions, where currencies are exchanged immediately, and derivatives such as forwards and options, which allow participants to agree on a future exchange rate.

Because forex involves exchanging currencies, its movements are closely tied to global trade, economic data, and government policies. Interest rates, inflation reports, and major geopolitical events can all cause shifts in exchange rates.

Because forex involves exchanging currencies, its movements are closely tied to global trade, economic data, and government policies. Interest rates, inflation reports, and major geopolitical events can all cause shifts in exchange rates.

Forex market vs other financial markets

Unlike stock markets, which have central exchanges like the London Stock Exchange (LSE) or New York Stock Exchange (NYSE), forex operates through a decentralised network of banks, financial institutions, and brokers. This means it is open 24 hours a day, 5 days a week, as trading moves across different time zones – from Asia to Europe and then to North America.

Forex vs stocks

- | Forex market | Stock market |

Market access | 24 hours a day, 5 days a week | Limited to exchange opening hours (e.g. 9:30 – 16:00) |

Liquidity | Extremely high due to global demand | Varies by stock |

Ownership | No ownership of physical assets when trading CFDs or speculative positions; in spot transactions, you are exchanging one currency for another | Shares represent partial ownership of a company |

Market structure | Decentralised (over-the-counter market) | Centralised (regulated stock exchanges) |

Diversification | Focused on currency pairs | Individual shares or sectors |

Trading style | Active, short-term trading | Active or long-term investing |

Risk level | Generally high due to volatility and leverage | Varies by stock, generally lower than forex |

Returns | Profits from currency price movements and leverage | Capital gains from rising prices and dividends |

Profit potential | Can profit from both rising and falling prices | Stock trading typically focuses on rising prices. Short selling is possible but can be more complex and subject to restrictions. |

Main influencing factors | Interest rates, central bank policies, economic indicators | Company earnings, industry trends, broader economic conditions |

Forex vs funds (Mutual funds, ETFs, Index funds)

- | Forex market | Funds (ETFs, Mutual funds, Index funds) |

Market access | 24 hours a day, 5 days a week | Limited to stock exchange trading hours |

Liquidity | Extremely high due to global demand | High for major ETFs, varies for mutual funds |

Ownership | No ownership of physical assets when trading CFDs or speculative positions; in spot transactions, you are exchanging one currency for another | Investors hold units or shares in the underlying assets |

Market structure | Decentralised (over-the-counter market) | Centralised (regulated exchanges or managed by institutions) |

Diversification | Focused on currency pairs | Spread across a range of assets for built-in diversification |

Trading style | Active, short-term trading | Passive or long-term investing |

Risk level | Generally high due to volatility and leverage | Typically lower, depending on the type of fund |

Returns | Profits from currency price movements and leverage | Fixed or variable returns based on market performance |

Profit potential | Can profit from both rising and falling prices | Primarily from rising prices over time |

Main influencing factors | Interest rates, central bank policies, economic indicators | Economic conditions, fund strategy, sector performance |

Forex vs bonds

- | Forex market | Bonds |

Market access | 24 hours a day, 5 days a week | Limited to exchange hours or bond market operating times |

Liquidity | Extremely high due to global demand | Moderate to high depending on issuer and market |

Ownership | No ownership of physical assets when trading CFDs or speculative positions; in spot transactions, you are exchanging one currency for another | Investors own the bond and receive interest payments |

Market structure | Decentralised (over-the-counter market) | Issued by governments or corporations, traded over-the-counter or on exchanges |

Diversification | Focused on currency pairs | Limited, tied to specific issuers |

Trading style | Active, short-term trading | Buy-and-hold investing |

Risk level | Generally high due to volatility and leverage | Generally lower, depending on the issuer and duration |

Returns | Profits from currency price movements and leverage | Earns fixed interest over time, with potential gains from bond price changes |

Profit potential | Can profit from both rising and falling prices | Primarily from interest payments, some price movement potential |

Main influencing factors | Interest rates, central bank policies, economic indicators | Central bank policy, inflation, credit ratings, and economic outlook |

Forex vs commodities

- | Forex market | Commodities market |

Market access | 24 hours a day, 5 days a week | Some commodities trade 24/5, others follow specific exchange hours |

Liquidity | Extremely high due to global demand | Can be high, depending on the commodity |

Ownership | No ownership of physical assets when trading CFDs or speculative positions; in spot transactions, you are exchanging one currency for another | Traded as physical assets or through derivative contracts |

Market structure | Decentralised (over-the-counter market) | Varies – centralised for futures, decentralised for spot |

Diversification | Focused on currency pairs | Limited, based on commodity type |

Trading style | Active, short-term trading | Active trading or used for hedging |

Risk level | Generally high due to volatility and leverage | Can be high due to supply shocks and volatility |

Returns | Profits from currency price movements and leverage | Can be high, depending on the commodity |

Profit potential | Can profit from both rising and falling prices | Physical assets or derivatives such as futures and options |

Main influencing factors | Interest rates, central bank policies, economic indicators | Supply and demand dynamics, weather conditions, geopolitical factors |

Size and scope of the forex market

The Bank for International Settlements (BIS) reported that in April 2022, the average daily turnover in global foreign exchange (FX) markets reached $7.5 trillion, marking a 14% increase from $6.6 trillion in April 2019.

The forex market is used by various participants, from central banks and multinational companies to retail traders and tourists exchanging money for travel. Because of its size and liquidity, forex is often considered one of the most efficient markets, with exchange rates reacting quickly to economic news, interest rate changes, and geopolitical events.

The forex market is used by various participants, from central banks and multinational companies to retail traders and tourists exchanging money for travel. Because of its size and liquidity, forex is often considered one of the most efficient markets, with exchange rates reacting quickly to economic news, interest rate changes, and geopolitical events.

Getting started with the basics of Forex trading

Before diving into strategies and platforms, it is important to understand the foundation of what forex trading actually is. This section will walk you through the core concepts, beginning with the definition and how currency pairs work in practice.

What is Forex trading?

DEFINITION

Forex trading is the process of buying one currency while simultaneously selling another, with the aim of benefiting from changes in the exchange rate.

If you were to look up how to trade forex, you will quickly find that it involves selecting a currency pair, such as GBP/USD, that represents an exchange rate – in this case British pounds to US dollars – and deciding whether you think the exchange rate will rise or fall.

EXAMPLE

Rather than trading an individual currency, you are effectively trading the exchange rate itself.

If you expect the GBP/USD rate to rise from 1.30 to 1.40, you would buy the pair. If you think it will drop to 1.20, you would sell it instead.

This is actually just the same principle as buying or selling a stock like Apple when you expect its price to go up or down.

If you expect the GBP/USD rate to rise from 1.30 to 1.40, you would buy the pair. If you think it will drop to 1.20, you would sell it instead.

This is actually just the same principle as buying or selling a stock like Apple when you expect its price to go up or down.

How does Forex trading work?

Unlike exchanging cash at a bank or foreign exchange desk for travel purposes, forex trading takes place electronically through a network of banks, brokers, and financial institutions. This is known as the interbank market.

Forex trades as an over-the-counter (OTC) market rather than being traded on a central exchange. Trading OTC is also why you can see more than one quote for a currency pair, like GBP/USD or EUR/USD, but only ever see one quote for Apple or Microsoft stock, which trade on the Nasdaq Exchange.

It is useful to know who you are in the forex market...

As a retail trader, you are trading alongside major institutions but without direct access to the interbank market. Unlike central banks, hedge funds, and multinational corporations, which trade in massive volumes, retail traders use forex brokers to access the market. Brokers bridge the gap between retail traders and institutional liquidity providers.

Forex trades as an over-the-counter (OTC) market rather than being traded on a central exchange. Trading OTC is also why you can see more than one quote for a currency pair, like GBP/USD or EUR/USD, but only ever see one quote for Apple or Microsoft stock, which trade on the Nasdaq Exchange.

It is useful to know who you are in the forex market...

As a retail trader, you are trading alongside major institutions but without direct access to the interbank market. Unlike central banks, hedge funds, and multinational corporations, which trade in massive volumes, retail traders use forex brokers to access the market. Brokers bridge the gap between retail traders and institutional liquidity providers.

You need a forex broker to make the transactions in the forex market on your behalf in a similar way to needing a stock broker to trade the stock market. The broker is your connection to the interbank market, which is inaccessible to individual retail traders.

For this you need to open a forex trading account and deposit funds.

Forex trading platforms provide real-time prices, allowing you to enter and exit positions at any time during market hours. Because of the scale and liquidity of forex, price changes can happen quickly, and trading strategies vary depending on how long a position is held.

Many regulated brokers offer access to both forex and CFD trading through a single account, typically supported by user-friendly platforms, competitive spreads, and essential trading tools.

For this you need to open a forex trading account and deposit funds.

Forex trading platforms provide real-time prices, allowing you to enter and exit positions at any time during market hours. Because of the scale and liquidity of forex, price changes can happen quickly, and trading strategies vary depending on how long a position is held.

Many regulated brokers offer access to both forex and CFD trading through a single account, typically supported by user-friendly platforms, competitive spreads, and essential trading tools.

Currency pairs in Forex

Before you can start trading in the forex market, it is essential to understand how currency pairs work. Unlike other markets where you buy a single asset, forex trading always involves two currencies. Let’s take a closer look at what forex pairs are and how they are quoted.

What is a Forex pair?

DEFINITION

A forex pair represents the exchange rate between two currencies, showing how much of one currency is needed to buy a unit of another.

In every forex transaction, one currency is bought while another is sold. This is why forex trading always involves pairs rather than individual currencies.

In every forex transaction, one currency is bought while another is sold. This is why forex trading always involves pairs rather than individual currencies.

For example, GBP/USD is a currency pair where the British pound (GBP) is compared against the US dollar (USD). If the exchange rate is 1.2500, this means £1 is worth $1.25. The price of a forex pair moves based on supply, demand, and wider economic factors.

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

Base and quote currencies explained

Each forex pair consists of two parts – the base currency and the quote currency.

The base currency refers to the first currency in the pair, while the quote currency is the second.

The base currency refers to the first currency in the pair, while the quote currency is the second.

The exchange rate shows how much of the quote currency you need to purchase one unit of the base currency. In forex trading, buying a currency pair means you are buying the base currency and selling the quote currency at the same time.

Major currency codes in the Forex market

Currency codes help traders quickly identify and differentiate between different forex pairs.

Currencies in forex are identified using ISO 4217 codes, which are three-letter abbreviations for each currency. The most commonly traded currencies include:

Currencies in forex are identified using ISO 4217 codes, which are three-letter abbreviations for each currency. The most commonly traded currencies include:

- GBP – British Pound

- USD – US Dollar

- EUR – Euro

- JPY – Japanese Yen

- CHF – Swiss Franc

- AUD – Australian Dollar

- CAD – Canadian Dollar

These currencies make up the major currency pairs, which involve the US dollar on one side, such as EUR/USD, GBP/USD, and USD/JPY.

Minor and exotic currency pairs

Currency pairs that don't include the US dollar are called cross currency pairs, such as EUR/GBP or AUD/JPY. These pairs are still commonly traded but usually have slightly wider spreads than major pairs due to lower liquidity (i.e. less people trading them).

In addition to majors and minors, there are exotic currency pairs, which involve a major currency paired with a currency from an emerging or smaller economy. Examples include:

In addition to majors and minors, there are exotic currency pairs, which involve a major currency paired with a currency from an emerging or smaller economy. Examples include:

Exotic pairs tend to be less liquid and more volatile, with larger spreads due to lower trading volume.

Which currency should I trade?

The choice of which currency pair to trade should depend almost entirely on whether there is the best opportunity, and whether you have the knowledge, skill and financial resources to take advantage of it.

For beginners, major pairs like EUR/USD or GBP/USD are a good starting point due to their high liquidity, tight spreads, lower volatility and the fact that there is the most written about these to get up to speed with the market.

Traders looking for more price movement may explore minor pairs like EUR/GBP or AUD/NZD, which tend to fluctuate more. More experienced traders might look at exotic pairs for larger price swings, but these pairs also come with higher spreads and potential slippage.

Ultimately, traders should consider their risk tolerance, trading strategy, and market conditions when choosing a currency pair to trade.

For beginners, major pairs like EUR/USD or GBP/USD are a good starting point due to their high liquidity, tight spreads, lower volatility and the fact that there is the most written about these to get up to speed with the market.

Traders looking for more price movement may explore minor pairs like EUR/GBP or AUD/NZD, which tend to fluctuate more. More experienced traders might look at exotic pairs for larger price swings, but these pairs also come with higher spreads and potential slippage.

Ultimately, traders should consider their risk tolerance, trading strategy, and market conditions when choosing a currency pair to trade.

What is a Forex broker?

DEFINITION

A forex broker is a particular type of financial services provider that gives traders access to the foreign exchange or FX market.

Because the forex market operates electronically and doesn't have a central exchange, brokers act as intermediaries. This is what makes it possible for individuals and institutions to buy and sell currency pairs through their trading platforms.

Because the forex market operates electronically and doesn't have a central exchange, brokers act as intermediaries. This is what makes it possible for individuals and institutions to buy and sell currency pairs through their trading platforms.

It is through a forex broker account where traders can place orders to buy or sell currencies.

FX brokers often also offer leverage, which enables traders to control larger positions than their initial deposit. However, using leverage increases both potential gains and potential losses, making it an important feature to understand before trading.

FX brokers often also offer leverage, which enables traders to control larger positions than their initial deposit. However, using leverage increases both potential gains and potential losses, making it an important feature to understand before trading.

There are two main types of forex brokers:

- Market makers set their own bid and ask prices and act as counterparties to their clients’ trades.

- ECN/STP brokers pass trades directly to the interbank market, where orders are matched between buyers and sellers.

Do not overlook regulation when choosing a broker!

In the UK, forex brokers are regulated by the Financial Conduct Authority (FCA), which ensures they follow industry standards and provide consumer protection. Checking whether a broker is FCA-authorised can help determine whether it operates within regulatory guidelines.

In Germany, brokers must comply with regulations set by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), one of Europe’s most stringent regulators, enforcing high compliance standards to protect investors and maintain market integrity.

In Cyprus, brokers are regulated by the Cyprus Securities and Exchange Commission (CySEC), adhering to MiFID II standards to ensure transparency, investor protection, and compliance across all EU member states.

Reputable brokers like Trading 212 operate under these regulators to provide a secure and transparent trading environment.

In the UK, forex brokers are regulated by the Financial Conduct Authority (FCA), which ensures they follow industry standards and provide consumer protection. Checking whether a broker is FCA-authorised can help determine whether it operates within regulatory guidelines.

In Germany, brokers must comply with regulations set by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), one of Europe’s most stringent regulators, enforcing high compliance standards to protect investors and maintain market integrity.

In Cyprus, brokers are regulated by the Cyprus Securities and Exchange Commission (CySEC), adhering to MiFID II standards to ensure transparency, investor protection, and compliance across all EU member states.

Reputable brokers like Trading 212 operate under these regulators to provide a secure and transparent trading environment.

How to start Forex trading yourself

If you are ready to take your first steps into forex trading, the process is more straightforward than you might think. From choosing a reliable broker to setting up your account, here is what you need to know to get started.

Setting up a brokerage account

Firstly you will have to choose the broker. Besides regulation mentioned above, comparing brokers based on fees, spreads, and available trading platforms is also useful when opening a forex trading account.

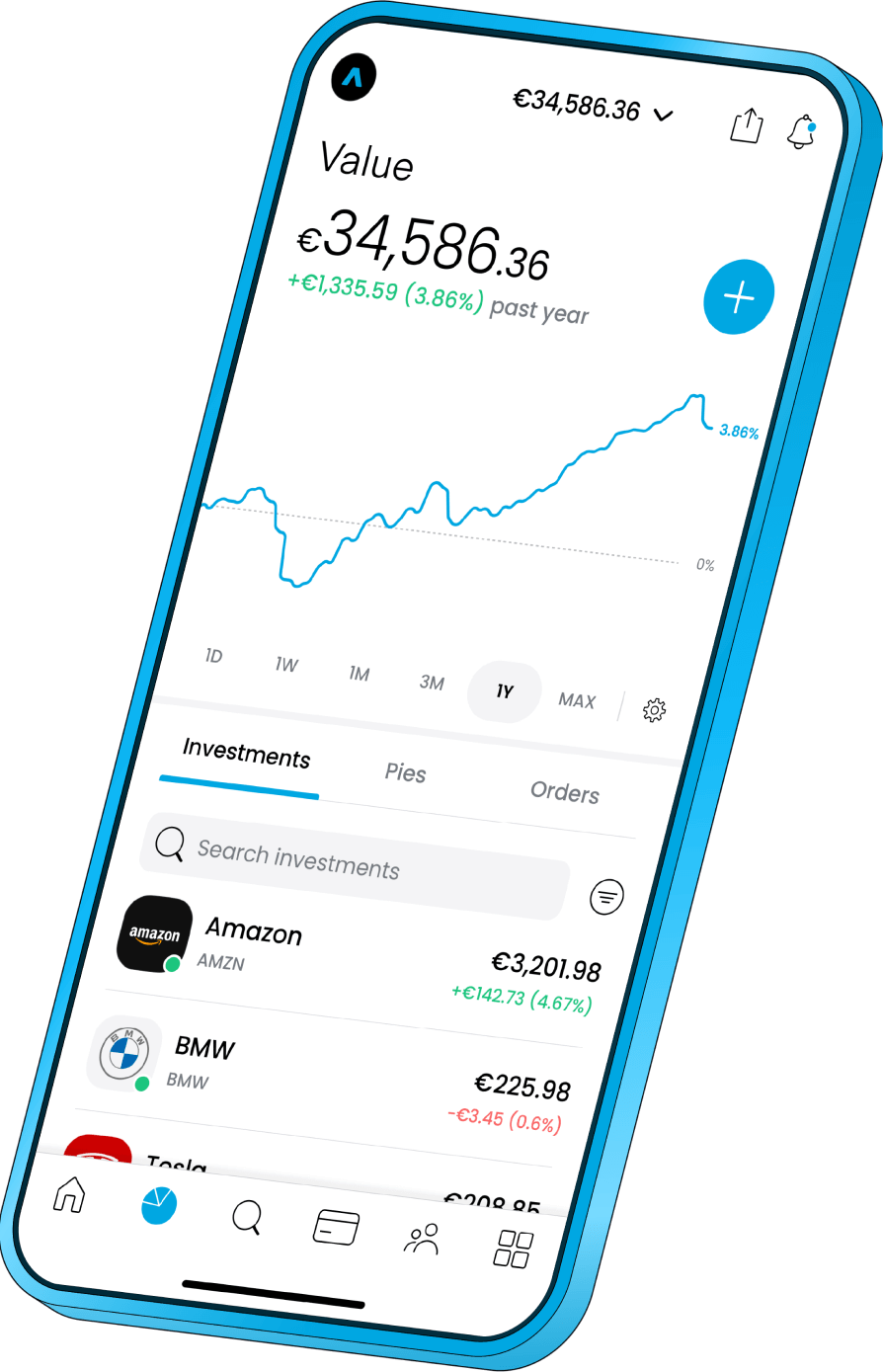

If you already have a Trading 212 invest account, it will be a simple process to open a CFD account and transfer funds to trade forex CFDs using the same easy-to-use investing app that you are already familiar with.

If you already have a Trading 212 invest account, it will be a simple process to open a CFD account and transfer funds to trade forex CFDs using the same easy-to-use investing app that you are already familiar with.

Source: Trading 212. The Trading 212 CFD account is not available for customers registered with Trading 212 AU.

Source: Trading 212. The Trading 212 CFD account is not available for customers registered with Trading 212 AU.When opening an account, you will typically need to provide identification and verify your details. Many brokers offer different types of accounts, such as standard, mini, or micro accounts, depending on how much capital you want to trade with.

Practicing with demo accounts

Once your account is set up, you can deposit funds and start placing trades. Brokers usually offer trading platforms with real-time charts, analysis tools, and order execution features, allowing you to monitor price movements and enter trades efficiently.

A demo account is a risk-free way to practice forex trading using virtual funds. Most brokers provide this feature, allowing you to trade under real market conditions without the risk of losing money.

Using a demo account can help you:

A demo account is a risk-free way to practice forex trading using virtual funds. Most brokers provide this feature, allowing you to trade under real market conditions without the risk of losing money.

Using a demo account can help you:

- Become familiar with a trading platform

- Test different order types, and see how price fluctuations affect your trades

- Understand concepts such as spreads, margin, and leverage in a practical setting

- Try different trading strategies before switching to a live account

NOTE: Demo trading doesn't fully replicate the psychological aspects of using real money. That said, a demo account can still be a useful way to build confidence and gain experience before trading live forex markets.

Forex currency trading for beginners

Before jumping into strategies or complex terms, it is important to understand the basics of how forex trading works — starting with the concept of long and short trades. Let’s break down what this means in practice.

Long and short trades explained

When dealing with a traditional financial market like stocks, it is usually all about buying a stock cheap and hopefully selling it when it gets more expensive for a profit, or taking a loss if it gets cheaper.

With forex trading it is perfectly normal to buy or sell a currency pair – buying in the hopes it gets more expensive or selling with a plan of buying it back cheaper later. This is known as going long or short.

With forex trading it is perfectly normal to buy or sell a currency pair – buying in the hopes it gets more expensive or selling with a plan of buying it back cheaper later. This is known as going long or short.

Going long means buying a currency pair in anticipation that the base currency will increase in value relative to the quote currency. For example, if you expect the GBP/USD exchange rate to rise, you would buy GBP/USD, aiming to sell it later at a higher price.

Going short means selling a currency pair with the expectation that the base currency will weaken against the quote currency. If you believe GBP/USD will fall, you would sell the pair and attempt to buy it back at a lower price.

Unlike traditional investing, where profits are typically made when prices rise, forex trading allows opportunities in both rising and falling markets.

If you were to only ever trade forex pairs that are rising, you would be missing out on opportunities to trade approximately half of the forex market, which could at the same time be falling.

Going short means selling a currency pair with the expectation that the base currency will weaken against the quote currency. If you believe GBP/USD will fall, you would sell the pair and attempt to buy it back at a lower price.

Unlike traditional investing, where profits are typically made when prices rise, forex trading allows opportunities in both rising and falling markets.

If you were to only ever trade forex pairs that are rising, you would be missing out on opportunities to trade approximately half of the forex market, which could at the same time be falling.

Scalping, day trading, swing trading, and position trading

Forex traders use different strategies depending on their timeframe, risk tolerance, and market outlook. As a beginner, learning about common trading styles can help in deciding which approach might be suitable. Some widely used methods include:

- Scalping – Making very short-term trades lasting seconds or minutes, targeting small price changes.

- Day trading – Opening and closing positions within the same trading day to avoid overnight exposure.

- Swing trading – Holding trades for days or weeks to capture medium-term price movements.

- Position trading – A long-term approach where trades may remain open for months, based on broader economic trends.

Trader style | Holding period | Trend chart | Entry chart |

Position trading | 1 day + | Weekly | Daily |

Swing trading | Few hours / days | Daily | 4-hour |

Day trading | < 1 day | 4-hour | Hourly |

Scalping | < Few hours | Hourly | 15-minute |

Each strategy comes with its own risks and requirements. While some traders prefer technical analysis (studying price charts and patterns), others use fundamental analysis, focusing on economic indicators and news events to make decisions.

Which forex trading strategy is right for me?

It really all boils down to how much time and energy you have to commit to forex trading. You might imagine yourself in and out of trades 100x per day – but if you have a full-time job, this is usually unrealistic. At the same time, risk tolerance and market knowledge are also factors.

Let’s go through each strategy again to outline how they tend to suit different types of traders:

Let’s go through each strategy again to outline how they tend to suit different types of traders:

- Scalping is best for those who can monitor the markets constantly and react quickly. This approach requires fast execution and low spreads.

- Day trading is quite suitable for traders who prefer to avoid overnight risks and focus on short-term price movements. It requires discipline and an ability to make quick decisions.

- Swing trading tends to be a good fit for those who cannot watch the markets all day but still want to take advantage of price trends. It allows for more flexibility.

- Position trading is ideal for traders who prefer a long-term perspective, basing decisions on macroeconomic trends and fundamental analysis rather than short-term price movements.

For beginners, swing trading or day trading may be a balanced starting point, offering enough market exposure without the extreme speed of scalping or the patience required for position trading. Testing strategies using demo accounts can help determine which style suits individual risk tolerance and lifestyle.

Beginner concepts in Forex trading

Getting started with forex means learning a few key terms that will come up time and again — and one of the most important is the pip. Understanding what a pip is and how it works will help you measure price movements, calculate profit and loss, and manage your trades more effectively. Let’s take a closer look.

What is a Pip in Forex?

DEFINITION

A pip is the standard unit of price movement in most currency pairs.

Whereas a penny (£0.01) is accurate enough for share prices, exchange rates like 1.2003 require a higher degree of accuracy (£0.0001) which is a pip.

Whereas a penny (£0.01) is accurate enough for share prices, exchange rates like 1.2003 require a higher degree of accuracy (£0.0001) which is a pip.

Usually, it is the fourth decimal place in a price quote – so if GBP/USD moves from 1.2500 to 1.2501, that is a one-pip change. Some pairs, like those involving the Japanese yen (JPY), quote prices with two decimal places instead of four, i.e. 125.20.

Some brokers also offer fractional pips, known as pipettes, which add an extra decimal place for even finer price detail, which in the case of GBP/USD would be 0.00001.

Pips measure three things – profit, loss, and price fluctuations.

Before placing a forex trade you can calculate the potential risk and reward of a trade setup in pips, using them as a unit of comparison.

Some brokers also offer fractional pips, known as pipettes, which add an extra decimal place for even finer price detail, which in the case of GBP/USD would be 0.00001.

Pips measure three things – profit, loss, and price fluctuations.

Before placing a forex trade you can calculate the potential risk and reward of a trade setup in pips, using them as a unit of comparison.

The spread and transaction costs in Forex

Forex is often commission-free but there are still fees per transaction. Most brokers make money by charging clients through the spread.

DEFINITION

The spread is the difference between the bid price (buy) and the ask price (sell).

The spread is measured in pips. To calculate the actual cost, you simply multiply the spread by the contract size.

EXAMPLE

A spread of 2.5 pips

On a $10,000 position

0.00025 x $10,000 = $2.50

On a $100,000 position

0.00025 x $100,000 = $25.00

On a $10,000 position

0.00025 x $10,000 = $2.50

On a $100,000 position

0.00025 x $100,000 = $25.00

Tighter spreads mean lower costs for traders, and major pairs (like EUR/USD or GBP/USD) usually have the narrowest spreads due to high liquidity. Less commonly traded pairs often have wider spreads, making trades more expensive.

Some brokers offer a tighter spread but then charge an additional commission per trade, while others make money purely from the spread.

Overnight positions may also incur swap fees otherwise known as rollover.

Some brokers offer a tighter spread but then charge an additional commission per trade, while others make money purely from the spread.

Overnight positions may also incur swap fees otherwise known as rollover.

Leverage in Forex

In forex trading, leverage is commonly applied through Contracts for Difference (CFDs). This means you can gain exposure to larger market positions without needing to commit the full trade value upfront.

You might have already come across the term trading on margin. In the stock market, this typically means you only need to put up a portion of the total value of your position. For example, with 5:1 leverage, buying $10,000 worth of stock would require just $2,000 in margin.

You might have already come across the term trading on margin. In the stock market, this typically means you only need to put up a portion of the total value of your position. For example, with 5:1 leverage, buying $10,000 worth of stock would require just $2,000 in margin.

DEFINITION

Leverage allows traders to control larger positions with a smaller deposit, amplifying both potential gains and losses.

Under UK and EU regulations, leverage on major currency pairs is typically capped at 30:1. In practice, this means a £1,000 deposit could give you control over a £30,000 forex position — but it also means losses can add up quickly if the market moves against you.

While leverage increases exposure, it also raises risk, and losses can exceed initial deposits. In the stock market, a trader can go into margin debt – meaning they have to pay extra to keep the trade open. However, forex brokers automatically close positions if losses result in the account balance falling below the margin requirement for the trade.

For example, you have £1,500 in your account and the margin requirement on a £30,000 forex trade is £1,000. If the losses on your open trade exceed £500 (the difference between your £1,500 account balance and your £1,000 margin requirement) your position would be closed.

For example, you have £1,500 in your account and the margin requirement on a £30,000 forex trade is £1,000. If the losses on your open trade exceed £500 (the difference between your £1,500 account balance and your £1,000 margin requirement) your position would be closed.

Lots in Forex trading

Forex trades are measured in lots, which determine the size of a position.

The standard lot sizes are:

The standard lot sizes are:

- Standard lot = 100,000 units of the base currency (the first currency in the pair)

- Mini lot = 10,000 units

- Micro lot = 1,000 units

- Nano lot = 100 units (offered by some but not all brokers)

A one-pip move in a standard lot typically equals $10 in most USD-based pairs. In a micro lot, that same pip movement would be worth just $1.

For beginners, trading real money but with small traded sizes using micro or mini lots offers a great way to get experience in the markets while also keeping the size of wins and losses limited.

For beginners, trading real money but with small traded sizes using micro or mini lots offers a great way to get experience in the markets while also keeping the size of wins and losses limited.

Forex order vs Forex deal

A forex order is an instruction to buy or sell a currency pair under certain conditions.

A forex deal refers to an executed order – meaning the trade has been completed.

Common order types include:

A forex deal refers to an executed order – meaning the trade has been completed.

Common order types include:

- Market order – A trade placed at the current market price.

- Limit order – A trade set to execute only at a better price, i.e. a lower price when buying and higher price when selling.

- Stop order – A trade set to execute only at a worse price, i.e. a higher price when buying or a lower price when selling.

- Stop-loss order – A protective order that closes a trade to prevent further losses.

To think about whether to use a stop or limit orders, you just need to imagine where the price you want to buy and sell is relative to the current market price.

Traders also use pending orders, which are only activated if price conditions are met.

Advanced concepts to know how to trade Forex

Once you’ve got the basics down, it is time to explore some of the more advanced concepts that experienced traders use to make informed decisions. One of the key areas to understand is the difference between technical and fundamental analysis, the two main approaches used to assess the market and identify trading opportunities.

Technical analysis vs Fundamental analysis

Forex traders generally rely on two main types of analysis in order to decide which currencies to buy and sell and when.

Fundamental analysis (FA)

FA focuses on economic indicators, interest rates, inflation, and global events that can affect currency values. In simple terms, you are trying to analyse which country has better economic prospects.

For example, if the Bank of England raises interest rates, the British pound may strengthen. This is because higher interest rates often attract foreign investment, increasing demand for the currency.

On the other hand, if the United States reports strong GDP growth, it is generally seen as a sign of a healthy economy. A strong economic outlook usually supports a stronger currency, so in this case, the US dollar could rise.

While a strong economy usually supports a stronger currency in countries with floating exchange rates (like the UK or US), some nations, such as China, actively manage their currency’s value. In these cases, a government or central bank may keep the currency weaker to support exports and maintain competitiveness abroad. So, the relationship between economic strength and currency value can vary depending on a country's exchange rate policy.

On the other hand, if the United States reports strong GDP growth, it is generally seen as a sign of a healthy economy. A strong economic outlook usually supports a stronger currency, so in this case, the US dollar could rise.

While a strong economy usually supports a stronger currency in countries with floating exchange rates (like the UK or US), some nations, such as China, actively manage their currency’s value. In these cases, a government or central bank may keep the currency weaker to support exports and maintain competitiveness abroad. So, the relationship between economic strength and currency value can vary depending on a country's exchange rate policy.

Technical analysis (TA)

TA examines past price movements and patterns using charts, indicators, and historical data to predict future price behaviour. The most powerful concept in technical analysis is that all markets trend, meaning the price moves in one broad direction over an extended time. Being on the right side of the trend helps puts the odds in your favour when trading.

Source: TradingView. Past performance is no guarantee of future results. This information is not investment advice. Do your own research.

Source: TradingView. Past performance is no guarantee of future results. This information is not investment advice. Do your own research. Source: TradingView. Past performance is no guarantee of future results. This information is not investment advice. Do your own research.

Source: TradingView. Past performance is no guarantee of future results. This information is not investment advice. Do your own research.Tools such as moving averages, trend lines, and support and resistance levels help traders identify potential entry and exit points. Moving averages can help smooth out price action and highlight the direction of the trend. Trend lines are used to visualise the overall momentum, while support and resistance levels help identify zones where price might pause, reverse, or break out.

Some forex traders rely solely on technical analysis, especially those trading on shorter timeframes like intraday or scalping strategies. Others combine technical indicators with fundamental analysis to gain a more comprehensive view of market dynamics — for example, using technical signals to time entries and exits around key economic events.

Some forex traders rely solely on technical analysis, especially those trading on shorter timeframes like intraday or scalping strategies. Others combine technical indicators with fundamental analysis to gain a more comprehensive view of market dynamics — for example, using technical signals to time entries and exits around key economic events.

Hedging with Forex: What you need to know

Exchange rates shift. Sometimes slightly, sometimes by a lot. That uncertainty is where forex hedging comes in. It is a way to offset risk but you can never eliminate it. Businesses hedge and so do traders.

A company expecting future payments in dollars may lock in today’s exchange rate instead of risking exchange rates moving in a way that would devalue the payment with a forward contract.

Retail traders might hedge by opening opposing positions to their current position, buying and selling the same pair or a correlated forex pair.

In the example shown, a trader enters a buy position, but as the market falls, they open a sell position as a hedge. If the market continues to decline, the sell position generates a profit that helps offset losses from the initial buy position. Once the market begins to recover, the trader can choose to close the sell position to benefit from the original buy trade.

A company expecting future payments in dollars may lock in today’s exchange rate instead of risking exchange rates moving in a way that would devalue the payment with a forward contract.

Retail traders might hedge by opening opposing positions to their current position, buying and selling the same pair or a correlated forex pair.

In the example shown, a trader enters a buy position, but as the market falls, they open a sell position as a hedge. If the market continues to decline, the sell position generates a profit that helps offset losses from the initial buy position. Once the market begins to recover, the trader can choose to close the sell position to benefit from the original buy trade.

The other way hedging is done via the forex market is buying/selling foreign currencies to offset the risks of buying shares in overseas companies or a foreign stock index. If the currency used to buy the stock or index changes value, the hedge position in the forex market might balance it out.

In summary, hedging is not about making money – it is about reducing exposure to unpredictable currency movements.

In summary, hedging is not about making money – it is about reducing exposure to unpredictable currency movements.

The role of the US dollar in the Forex market

The US dollar (USD) plays a central role in forex trading. It is the most traded currency, with the major currency pairs that always include the dollar, such as EUR/USD, GBP/USD and USD/JPY dominating trading volumes.

Why is the dollar so dominant? Several reasons. It is the world’s primary reserve currency, held as reserves by central banks worldwide. Additionally, commodities like oil, gold, and wheat are priced in dollars, increasing its demand as a necessity to make transactions in these commodities.

Even if you don’t trade a USD pair, its influence is unavoidable. Many traders monitor the US Dollar Index (DXY) to gauge dollar strength against a basket of currencies, as shifts in its value can affect forex trends globally.

Why is the dollar so dominant? Several reasons. It is the world’s primary reserve currency, held as reserves by central banks worldwide. Additionally, commodities like oil, gold, and wheat are priced in dollars, increasing its demand as a necessity to make transactions in these commodities.

Even if you don’t trade a USD pair, its influence is unavoidable. Many traders monitor the US Dollar Index (DXY) to gauge dollar strength against a basket of currencies, as shifts in its value can affect forex trends globally.

Forex currency trading strategies

Once you are familiar with the basics of how the forex market works, the next step is to explore trading strategies. These are structured approaches that traders use to make decisions based on market conditions, timing, and risk management. While strategies vary in complexity, even simple ones can offer a solid foundation for getting started.

Popular strategies followed by new traders

If you are new to forex, it is helpful to begin with straightforward strategies that are easy to understand and put into practice. These are commonly used by beginners to build experience, develop discipline, and learn how to navigate the fast-moving forex market.

Candlestick patterns

These are a popular tool for analysing price movements in forex. Each candlestick represents a specific timeframe and shows four key prices: open, close, high, and low. The shape and position of candlesticks can indicate market sentiment and potential trend reversals.

Common candlestick patterns include:

- Doji – A candle with a small or non-existent body, indicating market indecision.

- Engulfing Pattern – A larger candle completely covers the previous one, suggesting a shift in momentum.

- Hammer & Shooting Star – Patterns with long wicks that can signal potential reversals at key levels.

Candlestick patterns are often used alongside other indicators like support and resistance levels or trendlines to strengthen their predictive value. Since forex prices move continuously, traders look for repeated patterns that align with other technical signals before making decisions.

Support and resistance

You can see these as horizontal levels on a price chart where currency pairs have previously struggled to move beyond them, acting as potential turning points in the market.

- Support – A level where demand is strong enough to prevent further decline. Price may bounce off this level multiple times.

- Resistance – A level where selling pressure stops prices from rising further.

Traders use support and resistance levels to identify potential entry and exit points. If price approaches a support level and holds, some traders may consider it a buying opportunity. If price struggles to break through resistance, it might be seen as a sign to sell or take profits.

When price breaks through support or resistance, it may indicate the start of a new trend. Some traders wait for confirmation, such as a retest of the level, before acting on the breakout.

When price breaks through support or resistance, it may indicate the start of a new trend. Some traders wait for confirmation, such as a retest of the level, before acting on the breakout.

Trend following (trendlines & moving averages)

A trend-following strategy focuses on identifying and trading in the direction of the prevailing price movement. Traders use trendlines and moving averages among other tools to help determine whether a market is in an uptrend, downtrend, or ranging phase.

- Trendlines – Straight lines drawn along price highs (for downtrends) or price lows (for uptrends) to visually confirm the trend direction.

- Resistance – A level where selling pressure stops prices from rising further.

- Simple Moving Average (SMA) – A basic average that reacts more slowly to price changes.

- Exponential Moving Average (EMA) – Gives more weight to recent prices, responding faster to new trends.

When price stays above a moving average, traders may view it as a sign of an uptrend. If price remains below, it may indicate a downtrend. Many traders combine moving averages with support and resistance levels for additional confirmation.

News trading

News trading is a strategy that focuses on market reactions to economic announcements, central bank decisions, and geopolitical events. Forex prices can move rapidly when key data like interest rate changes, inflation reports, or employment figures are released.

Traders using this approach often monitor an economic calendar to anticipate high-impact news events.

Common news-related price movements include:

Traders using this approach often monitor an economic calendar to anticipate high-impact news events.

Common news-related price movements include:

- High volatility after major announcements (e.g., U.S. Federal Reserve interest rate decisions).

- Sharp price gaps when markets open after unexpected news.

- Short-lived price spikes followed by a reversal as traders react emotionally before reassessing fundamentals.

News trading requires fast execution, as prices can fluctuate within seconds.

There are different ways to go about it. Some traders enter positions before a news event, speculating on the outcome, while others wait for initial volatility to settle before acting.

There are different ways to go about it. Some traders enter positions before a news event, speculating on the outcome, while others wait for initial volatility to settle before acting.

Carry trades

A carry trade is a long-term forex strategy where the aim is to profit from differences in interest rates between two currencies. This involves borrowing a low-interest-rate currency and using it to buy a higher-yielding currency. The goal is to collect the interest rate differential, known as the carry.

For example, if a trader sells Japanese yen (JPY) (which historically has low interest rates) and buys Australian dollars (AUD) (which often has higher rates), they could earn interest on the AUD position. Over time, this interest can accumulate, adding to any potential gains from exchange rate movements.

Carry trades are more common in low-volatility markets, as sudden currency price fluctuations can offset interest earnings. They are also sensitive to central bank policy changes – if the interest rate gap narrows, the appeal of the trade weakens, and positions may unwind quickly.

For example, if a trader sells Japanese yen (JPY) (which historically has low interest rates) and buys Australian dollars (AUD) (which often has higher rates), they could earn interest on the AUD position. Over time, this interest can accumulate, adding to any potential gains from exchange rate movements.

Carry trades are more common in low-volatility markets, as sudden currency price fluctuations can offset interest earnings. They are also sensitive to central bank policy changes – if the interest rate gap narrows, the appeal of the trade weakens, and positions may unwind quickly.

Essential risk management techniques in Forex trading

There are many ways to define risk, but at its core, it is the chance of losing money. The most severe outcome is losing your entire trading balance — often referred to as blowing up your account — which means you are left without the capital to continue trading.

In forex, risk is always present. Exchange rates move constantly, and while many changes are minor, sharp and unexpected shifts can and do happen — especially around major news or economic events. Understanding these risks is the first step to managing them effectively.

In forex, risk is always present. Exchange rates move constantly, and while many changes are minor, sharp and unexpected shifts can and do happen — especially around major news or economic events. Understanding these risks is the first step to managing them effectively.

Understanding risks in Forex trading

There are lots of different ways to describe risk with different types of risk but the central one is the risk of losing money – with the ultimate risk being that you lose all your money (blow up your account) – leaving you without the capital to keep trading.

Risk is unavoidable in forex trading. Exchange rates fluctuate constantly, and while some movements are small, others can be sharp and unexpected.

Other risks include:

Risk is unavoidable in forex trading. Exchange rates fluctuate constantly, and while some movements are small, others can be sharp and unexpected.

Other risks include:

- Market risk – The potential for prices to move against your trade.

- Liquidity risk – When price movements widen spreads or make it harder to close a trade at the desired price.

- Execution risk – Orders may not always fill at the expected price, especially during high volatility.

While risk cannot be eliminated, risk management techniques can help reduce exposure and improve longevity in the market.

Importance of risk management strategies

Forex trading is not just about finding good trades. It is about managing risk effectively. Even professional traders experience losses, but those who stay in the market long-term focus on limiting the size of their losses while maximising potential gains.

The three core risk management techniques are:

The three core risk management techniques are:

- Setting stop-loss orders – Automatically closes a trade if it moves beyond a predefined loss limit.

- Position sizing – Controlling how much of your account is risked per trade, often using the 1-2% rule (risking no more than 1-2% of your total account balance on a single trade).

- Risk-reward ratio – Aiming for a trade setup where potential profit outweighs potential loss, e.g., risking £100 to target a £300 gain (1:3 risk-reward ratio).

Applying these principles can help ensure that no single loss wipes out your trading account, allowing you to stay in the game long enough to develop skills and refine your strategies.

Common risks faced by traders

Many traders start forex trading without fully considering the risks involved. Some of the most common risks include:

- Overleveraging – Using too much leverage can amplify both profits and losses. A small adverse price movement could trigger a margin call, forcing an early exit.

- Emotional trading – Fear and greed often lead to impulsive decisions, such as chasing the market or holding onto losing trades too long.

- Slippage – Price movements during high volatility may cause trades to be executed at a worse price than expected, increasing losses. Getting high quality execution on your trades to minimise slippage – especially in fast-moving markets is another reason to choose a regulated broker in a trusted location.

By recognising these risks, traders can put preventative measures in place, such as using appropriate leverage levels, setting stop-loss orders, and maintaining a disciplined approach to position sizing and trade execution.

Factors influencing the Forex market

To trade forex with confidence, it helps to understand what actually moves the market. While currency prices might appear to fluctuate at random, there are several key forces at play — and being aware of them can give you an edge.

What moves the Forex market?

Forex prices are constantly shifting as institutions and people buy and sell currency for various reasons.

At the heart of it all is supply and demand. If more participants want to buy a currency than sell it, its value will rise. If more are selling, the price will fall. Simple in theory, but in practice, many different factors influence those flows.

What is less commonly known is just how much of the daily forex trading volume comes from speculation — traders aiming to profit from price changes, rather than conducting international trade or hedging corporate exposure.

Estimates suggest that 90-95% of forex market activity is speculative, making up a large portion of the $7.5 trillion+ traded daily (as of 2022). This means that short-term sentiment, technical analysis, and reaction to news can all have a major impact on currency movements.

At the heart of it all is supply and demand. If more participants want to buy a currency than sell it, its value will rise. If more are selling, the price will fall. Simple in theory, but in practice, many different factors influence those flows.

What is less commonly known is just how much of the daily forex trading volume comes from speculation — traders aiming to profit from price changes, rather than conducting international trade or hedging corporate exposure.

Estimates suggest that 90-95% of forex market activity is speculative, making up a large portion of the $7.5 trillion+ traded daily (as of 2022). This means that short-term sentiment, technical analysis, and reaction to news can all have a major impact on currency movements.

Breakdown of Forex market participants

To truly understand how the forex market works, it is important to know who is actually participating in it — and why. Unlike some financial markets, forex is not driven solely by investment or economic necessity. It is a fast-paced global market where the majority of activity comes from speculation. Let’s take a closer look at the key players and the roles they play.

Speculative trading (90-95%)

- Hedge funds, proprietary trading firms, retail traders, and institutional investors trade for profit rather than real currency needs.

- High-frequency trading (HFT) and algorithmic trading play a large role, executing thousands of trades per second.

- Data provided by Triennial Central Bank Survey

Commercial and investment flows (5-10%)

- Multinational corporations, businesses and to a lesser extent governments exchange currencies for imports, exports, and foreign direct investment.

- Central banks intervene in markets to stabilise or influence exchange rates.

- Data provided by Triennial Central Bank Survey

Key influences include:

- Interest rates – Higher interest rates often attract investment, increasing demand for a currency.

- Economic data – Reports on GDP, inflation, employment, and trade balances can affect a currency’s strength.

- Political events – Elections, policy changes, and geopolitical tensions can create uncertainty, impacting forex markets.

- Global trade flows – Countries with trade surpluses may see their currency strengthen as demand for it rises.

While some price movements follow predictable patterns, others are unexpected – making forex trading highly dynamic and requiring traders to stay informed about key market drivers.

Central banks and their impact

Central banks play a critical role in forex markets. They control monetary policy, set interest rates, and manage currency reserves to influence economic stability. Major central banks include:

- Bank of England (BoE) – Regulates the British pound (GBP)

- Federal Reserve (Fed) – Oversees US dollar (USD) policy

- European Central Bank (ECB) – Governs the euro (EUR)

When a central bank raises interest rates, it can make a currency more attractive to investors, increasing demand. A rate cut, on the other hand, may weaken a currency as investors seek higher returns elsewhere.

In recent years, especially since the 2008 global financial crisis, central banks have used quantitative easing as an additional tool in monetary policy. This involves buying large swathes of government securities, creating artificial demand for bonds, which drives down interest rates and supports market sentiment.

Central banks can also intervene in forex markets by buying or selling currencies to stabilise exchange rates but usually avoid doing so to allow floating exchange rates. Traders often monitor central bank statements, looking for policy shifts that might trigger significant price movements in major currency pairs.

In recent years, especially since the 2008 global financial crisis, central banks have used quantitative easing as an additional tool in monetary policy. This involves buying large swathes of government securities, creating artificial demand for bonds, which drives down interest rates and supports market sentiment.

Central banks can also intervene in forex markets by buying or selling currencies to stabilise exchange rates but usually avoid doing so to allow floating exchange rates. Traders often monitor central bank statements, looking for policy shifts that might trigger significant price movements in major currency pairs.

Influence of news reports

There are two categories of news that affect the forex market:

- Scheduled news or economic data

- Unexpected news

News will tend to trigger sharp movements in forex markets when

- The actual data differs substantially from expectations

- The news was unexpected such as geopolitical events, natural disasters or major corporate scandals

Some of the most impactful reports include:

- Employment data – Reports like the UK unemployment rate or US Non-Farm Payrolls (NFP) often lead to volatility.

- Inflation figures – Higher-than-expected Consumer Price Index (CPI) data may suggest a central bank could raise interest rates, strengthening the currency whereas lower-than-expected often has the reverse effect.

- GDP growth reports – Stronger-than-expected growth can boost a currency, while weak GDP figures may lead to depreciation.

Some traders avoid trading around high-impact news events due to the risk of slippage and widened spreads, while others specifically focus on news trading strategies (see below) to capitalise on volatility.

Market sentiment and speculation

There is still trading going on, with exchange rates moving – even when there is no news scheduled or there is an obvious fundamental trigger – in fact, this is the case most of the time. So what is the driving force? Sentiment.

Market sentiment reflects how traders collectively feel about a currency’s outlook. Unlike fundamental analysis, which looks at economic data, sentiment is based on trader psychology and positioning.

Market sentiment reflects how traders collectively feel about a currency’s outlook. Unlike fundamental analysis, which looks at economic data, sentiment is based on trader psychology and positioning.

Risk-on vs risk-off

In stable markets, traders may seek higher-yielding currencies (risk-on). During uncertainty, they may shift to safe-haven currencies like USD, JPY, or CHF (risk-off).

Speculative positioning

Large financial institutions and hedge funds have an outsized influence on price movements through speculative bets on future currency trends. When these bets get too one-sided, that is to say nearly everybody is betting on the same outcome, the market can easily snap back the other way.

Sentiment indicators, such as the Commitments of Traders (COT) report, show how institutional traders are positioned. Forex traders can also monitor price trends and momentum indicators to gauge sentiment shifts as they are reflected in the price.

Sentiment indicators, such as the Commitments of Traders (COT) report, show how institutional traders are positioned. Forex traders can also monitor price trends and momentum indicators to gauge sentiment shifts as they are reflected in the price.

Types of Forex transactions

We have spoken so far about the movement of currencies and the understanding one needs about the market and how to trade forex. What we will cover now is the precise types of contracts that are available to trade the forex market. There are 3 main types:

1. Spot market

Most retail forex trading takes place in the spot market through online brokers, where traders react to price changes as they happen.

The spot market is where currencies are bought and sold for immediate settlement at the current exchange rate, known as the spot price. Transactions typically settle within two business days, though some pairs, such as USD/CAD, settle in one day.

The spot market is the most liquid part of forex trading, with prices fluctuating in real time due to supply and demand, interest rates, and economic data. Traders in the spot market engage in short-term speculation, while businesses and financial institutions use it to exchange currencies for trade and investment purposes.

The spot market is where currencies are bought and sold for immediate settlement at the current exchange rate, known as the spot price. Transactions typically settle within two business days, though some pairs, such as USD/CAD, settle in one day.

The spot market is the most liquid part of forex trading, with prices fluctuating in real time due to supply and demand, interest rates, and economic data. Traders in the spot market engage in short-term speculation, while businesses and financial institutions use it to exchange currencies for trade and investment purposes.

2. Forward market

Unlike the spot market, where transactions happen immediately, forward contracts are used to lock in exchange rates for future transactions.

For example, a UK business expecting a payment in US dollars in three months may enter a forward contract to convert those dollars into pounds at today’s rate, hedging against potential currency fluctuations over the coming three months.

Forward contracts are customised agreements between two parties, making them over-the-counter (OTC) instruments, rather than exchange-traded. They are commonly used by corporations, financial institutions, and investors managing foreign exchange risk.

For example, a UK business expecting a payment in US dollars in three months may enter a forward contract to convert those dollars into pounds at today’s rate, hedging against potential currency fluctuations over the coming three months.

Forward contracts are customised agreements between two parties, making them over-the-counter (OTC) instruments, rather than exchange-traded. They are commonly used by corporations, financial institutions, and investors managing foreign exchange risk.

3. Futures market

The futures market is similar to the forward market but operates on regulated exchanges with standardised contracts. The purpose of futures contracts tends to be the same as spot forex - speculation or hedging. These contracts specify the currency pair, contract size, and settlement date, removing the need for direct negotiation between buyers and sellers.

Forex futures are publicly traded so there is more transparency and liquidity. Traders and institutions use them for hedging against currency fluctuations or speculating on price movements.

Forex futures are publicly traded so there is more transparency and liquidity. Traders and institutions use them for hedging against currency fluctuations or speculating on price movements.

Pros and cons of trading Forex

Some of the pros and cons of forex trading overlap those of trading stocks or any other market, namely the possibilities for gains but also the inherent risks. Below are some specific advantages and disadvantages of forex vs other types markets for retail trading.

Advantages of Forex trading

Category | Description |

Potential for high returns | Traders can profit from rising and falling markets, with leverage amplifying gains. However, losses can also be significant. |

Accessibility and flexibility | Forex is open 24/5, allowing traders to trade at any time. Small deposits enable easy market access. |

Diverse strategies available | Traders can use short-term or long-term strategies, including technical and fundamental analysis. |

Disadvantages of Forex trading

Category | Description |

High risk | Leverage increases risk, and market moves can lead to significant losses without proper risk management. |

Volatility | Prices react quickly to news and events, causing sudden spikes that may trigger stop-losses or slippage. |

Complexity | Understanding multiple economies, central bank policies, and global trade makes forex complex for beginners. |

Recap

Forex trading involves the exchange of currencies in a global, decentralised market that operates 24/5. To trade it, one must understand the role of currency pairs, exchange rates, and the influence of central banks, news events, and market sentiment.

Various trading strategies, such as news trading, trend following, and candlestick analysis, help traders identify opportunities. Risk management techniques, including stop-loss orders and position sizing, are essential to managing market volatility and leverage.

Summing it up before you choose to open a forex demo trading account, while forex offers high potential returns and flexibility, it also carries significant risks due to complexity and rapid price movements.

Various trading strategies, such as news trading, trend following, and candlestick analysis, help traders identify opportunities. Risk management techniques, including stop-loss orders and position sizing, are essential to managing market volatility and leverage.

Summing it up before you choose to open a forex demo trading account, while forex offers high potential returns and flexibility, it also carries significant risks due to complexity and rapid price movements.

FAQ

Q: Can you make money with Forex trading?

Forex trading can generate profits, but it also carries high risk of losses too. Success depends on market knowledge, risk management, and strategy.

Q: Is Forex hard to learn?

Forex can be complex due to economic influences, price fluctuations, and risk management, but with structured learning, practice, and discipline, traders can build an understanding over time.

Q: How much money do I need to start Forex trading?

Many brokers allow traders to start with as little as £50-£100, but a larger capital base is often recommended for greater flexibility and effective risk management.

Q: Can you learn Forex by yourself?

Yes, forex trading can be self-taught through educational resources, demo accounts, and market research, though structured courses can help speed up the learning process.

Q: Do I need a license to trade Forex?

For personal trading, no license is required. However, running a forex brokerage or offering trading services to others may require regulatory approval.

Q: Do Forex traders need to be registered?

Retail forex traders do not need to register with any authority, but professional fund managers and brokers require regulatory approval.

Q: Is Forex trading gambling?

Forex trading involves analysis, strategy, and risk management, making it different from gambling. However, trading without a plan or risk control is highly speculative.

Q: Is Forex legal in the UK?

Yes, forex trading is legal in the UK and regulated by the Financial Conduct Authority (FCA), ensuring brokers follow strict compliance rules.

Q: How to trade Forex in the UK?

To trade forex in the UK, open an account with an FCA-regulated broker such as Trading 212, deposit funds, and place trades using a trading platform. Use the knowledge from this article as a starting point to learn more about how forex trading works.

Q: Do Forex traders pay tax in the UK?

Forex trading profits may be subject to Capital Gains Tax (CGT) or Income Tax, depending on whether it is classified as speculative or part of a trading business. Tax treatment depends on individual circumstances.

Q: Is Forex trading a good career in the UK?

Forex trading is not a career with a job per se. It can be profitable, but it requires skill, capital, and discipline. It can also serve as a secondary income source rather than a full-time career.

Q: Can I trade Forex in Europe?

Yes, forex trading is available in Europe, with brokers regulated under ESMA rules in the EU and local financial authorities in each country.

Q: What is the best time to trade Forex in Europe?

The London session (08:00-16:00 GMT) and New York-London overlap (13:00-17:00 GMT) see the highest liquidity and price movements.

Q: Is Forex trading legal in Germany?

Yes, forex trading is legal in Germany and regulated by BaFin (Federal Financial Supervisory Authority), ensuring market transparency and broker compliance.