When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Qualifying Money Market Fund (QMMF): How it is defined and what is in it

Whether you are managing a corporate cash pile or just want a safer spot for your own money, understanding QMMFs could mean the difference between peace of mind and unexpected risk. Here is why they stand out.

Big ideas

- The main focus of Qualified Money Market Funds (QMMFs) is to offer investors stable, low-risk returns while preserving capital and liquidity. UK QMMFs will typically invest in gilts and fixed-term deposits, which are highly liquid and stable. Regulatory oversights provide another layer of security.

- QMMFs are a great option for those looking to store excess cash reserves, particularly large institutions. New capital rules have made it more expensive for banks to accept short-term deposits, and QMMFs are a useful alternative. With the introduction of MiFID 2, they increased in popularity.

- QMMF trading in the UK is governed by the Financial Conduct Authority (FCA). The FCA is responsible for interpreting and implementing the European MiFID directive for UK-based firms looking to invest client funds in QMMFs.

What is a QMMF (Qualifying Money Market Fund)?

DEFINITION

A Qualifying Money Market Fund (QMMF) is a specific kind of Money Market Fund (MMF) with a higher standard of regulatory requirements. They offer low-risk returns with a stable Net Asset Value (NAV) by focusing on short-term, high-quality financial instruments.

A QMMF is similar to any other MMF, except that it undergoes stricter regulatory scrutiny, which may influence liquidity, stability, risk, valuation, and investor protection.

The introduction of MiFID II in 2018 made it more difficult for financial services firms to place client money in banks over the short term. As a result, such firms have taken an increased interest in QMMF trading.

The following are the criteria for QMMFs as set out by the Institutional Money Market Funds Association (IMMFA), the trade association representing the industry in Europe:

The following are the criteria for QMMFs as set out by the Institutional Money Market Funds Association (IMMFA), the trade association representing the industry in Europe:

- Its primary investment objective must be to maintain the Net Asset Value of the undertaking either constant at par (net of earnings), or at the value of the investors’ initial capital plus earnings.

- It must, with a view to achieving that primary investment objective, invest exclusively in high-quality money market instruments with a maturity or residual maturity of no more than 397 days, or regular yield adjustments consistent with such a maturity.

- It must provide liquidity through same-day or next-day settlement.

Aside from these rules, there are other criteria, including the strict consent of the client that funds are being placed in a QMMF. Funds cannot be placed in a QMMF by an FCA-regulated entity without client consent.

Definition and history of QMMFs

The concept of QMMFs first emerged after the 2008 financial crisis when regulators sought to strengthen MMF resilience and reduce systemic risks. The US Reserve Primary Fund, linked to Lehman Brothers, was unable to maintain a price of $1, and broke the buck.

In 2017, the EU MMF Regulation introduced the QMMF classification, mandating stricter liquidity buffers, risk limits, and transparency measures. Similar regulatory enhancements followed globally, shaping QMMFs into safer investment vehicles.

QMMF trading is ideal for institutional investors seeking a low-risk, liquid investment aligned with regulatory requirements. However, a common misconception is that they are equivalent to a bank deposit. This is not true, as they do not offer the same guarantees as a bank, and are usually not insured.

In 2017, the EU MMF Regulation introduced the QMMF classification, mandating stricter liquidity buffers, risk limits, and transparency measures. Similar regulatory enhancements followed globally, shaping QMMFs into safer investment vehicles.

QMMF trading is ideal for institutional investors seeking a low-risk, liquid investment aligned with regulatory requirements. However, a common misconception is that they are equivalent to a bank deposit. This is not true, as they do not offer the same guarantees as a bank, and are usually not insured.

A list of Qualifying Money Market Funds by company

Many large institutions have released their own QMMFs in the UK and abroad. Each has distinct pros, cons, and requirements.

- Royal London short term Money Market Fund is a UK-based QMMF that aims to preserve capital and provide income by investing in high quality, short-term instruments such as UK Treasury bills, commercial paper, and certificates of deposit.

- L&G Sterling Liquidity Fund – This fund seeks investments in short-term obligations that have a high quality credit rating. These include repurchase agreements, Treasury Bills, and UK government gilts. This fund is solely for institutional investors as it provides a blend of high liquidity, low risk, and good interest. The fund is managed by Darewdiad Trust and complies with Money Market Fund Regulation in the European Union. The fund is managed by Legal & General Investment Management (LGIM).

- Aberdeen Standard Liquidity Fund – This sterling denominated QMMF focuses on UK corporate bonds and other quality short-debt obligations. It is a floating fund that allows withdrawals at any time without prior notice or deadline.

- BlackRock ICS Sterling Liquidity Fund – This fund is part of BlackRock’s Institutional Cash Series (ICS). This fund is divided into a low and high risk category, and all asset backed securities including UK government gilts, corporate commercial bills, and direct debt contracts including repurchase agreements are in the high risk portfolio. MMFR compliant structures are a prerequisite for such funds and these are complied with in this fund.

Money market fund regulation in the UK and EU

There have been changes since Brexit, but the UK and the EU have practically comparable regulations concerning MMF. The MMFR sets forth regulations for an MMF operating within the borders of the European Economic Area (EEA). It has intensive requirements regarding liquidity, credit, and risks associated with investments. MMF's covered are those classified under public debt, lower risk NAV funds, and funds with NAV that fluctuates.

Now the UK administers its own MMFs through the FCA. This means that the UK is now free to change rules and regulations without seeking permission from the EU. For all intents and purposes, however, the fundamental provisions are still the same.

Now, the UK could scale back some of the stress testing rules and certain liquidity requirements to better fit the local markets. This also means that UK MMFs are no longer automatically recognized under EU rules, meaning UK funds need EU approval to be sold across Europe.

Now the UK administers its own MMFs through the FCA. This means that the UK is now free to change rules and regulations without seeking permission from the EU. For all intents and purposes, however, the fundamental provisions are still the same.

Now, the UK could scale back some of the stress testing rules and certain liquidity requirements to better fit the local markets. This also means that UK MMFs are no longer automatically recognized under EU rules, meaning UK funds need EU approval to be sold across Europe.

The NAV standard refers to the method used to calculate the value of an MMF and determine the share price.

As a reminder, NAV is calculated by subtracting the fund’s liabilities from its total assets and dividing by the outstanding shares.

You can breakdown money market funds according to how they treat the NAV:

As a reminder, NAV is calculated by subtracting the fund’s liabilities from its total assets and dividing by the outstanding shares.

You can breakdown money market funds according to how they treat the NAV:

- Constant NAV (CNAV) funds: The main differentiator is that CNAVs aim to keep the Net Asset Value at £1, $1, or €1 per share. This is possible using low risk, short-term investments and amortised cost accounting. Commonly used for low-risk, highly liquid cash management.

- Variable NAV (VNAV) funds: Unlike CNAV, VNAV does not keep a fixed NAV but lets the share price fluctuate according to the performance of the underlying assets. It is often favoured by investors who are happy to accept the extra volatility for the potential of extra returns.

- Low Volatility NAV (LVNAV) funds: Came about via EU MMF-specific regulation and is a crossbreed between CNAV and VNAV. The concept is to keep the NAV stable at £1 or €1 (i.e. CNAV) unless the price fluctuates by more than 0.2%, in which case it will flip into a floating NAV (like VNAV). Used widely for corporate and institutional cash management.

The NAV standard allows investors to monitor the performance of the fund and purchase or redeem shares at appropriate value. This is useful for maintaining credibility as well as ensuring that the value of the fund correlates to its holdings.

Benefits of investing in QMMFs

QMMF trading comes with advantages and disadvantages. Like all investments, it is important to know the nature of the underlying asset and the wider market.

- High liquidity – QMMFs invest in short-term, highly-liquid instruments, ensuring quick access to funds without compromising much on returns. This makes them ideal for investors who need flexibility and easy access to their cash.

- Low credit risk – by adhering to strict regulations on credit quality, QMMFs invest in low risk securities, reducing exposure to defaults and enhancing stability compared to other higher risk funds.

- Regulatory oversight – QMMFs operate under stringent regulatory frameworks, such as the EU MMF Regulation, ensuring compliance with rules for liquidity, diversification, and transparency, which adds an extra layer of protection for investors.

- Competitive yields – due to their focus on high quality, short-term debt instruments, QMMFs often provide competitive yields compared to other cash management options.

Disadvantages of investing in QMMFs

- Lower returns – Although still reasonably competitive, the yields on QMMFs are almost always lower than more riskier investments like equities or corporate bonds. So if you are looking to take on more risk for higher returns. Probably better to look elsewhere.

- Limited investment scope – With the whole emphasis being on safety and security of funds, there are of course tight regulations on credit quality and diversification for QMMFs. These restrictions on the types of investments they can make limit their potential for significant returns.

- Exposure to interest rate risk – Sensitivity to interest rate changes is one of your standout considerations because once a country’s central bank lowers the benchmark lending rate for the country, it tends to lead directly to a lower yield in your QMMF fund, which also tends to support the performance of non-interest bearing assets like stocks or gold, adding an opportunity cost to have your money tied up in a QMMF.

- No deposit protection – A big point here! QMMFs are not bank accounts so they are not insured under deposit protection schemes, which means you could potentially face losses in extreme market situations, although this risk is generally low due to regulatory controls.

QMMF Trading 212 review

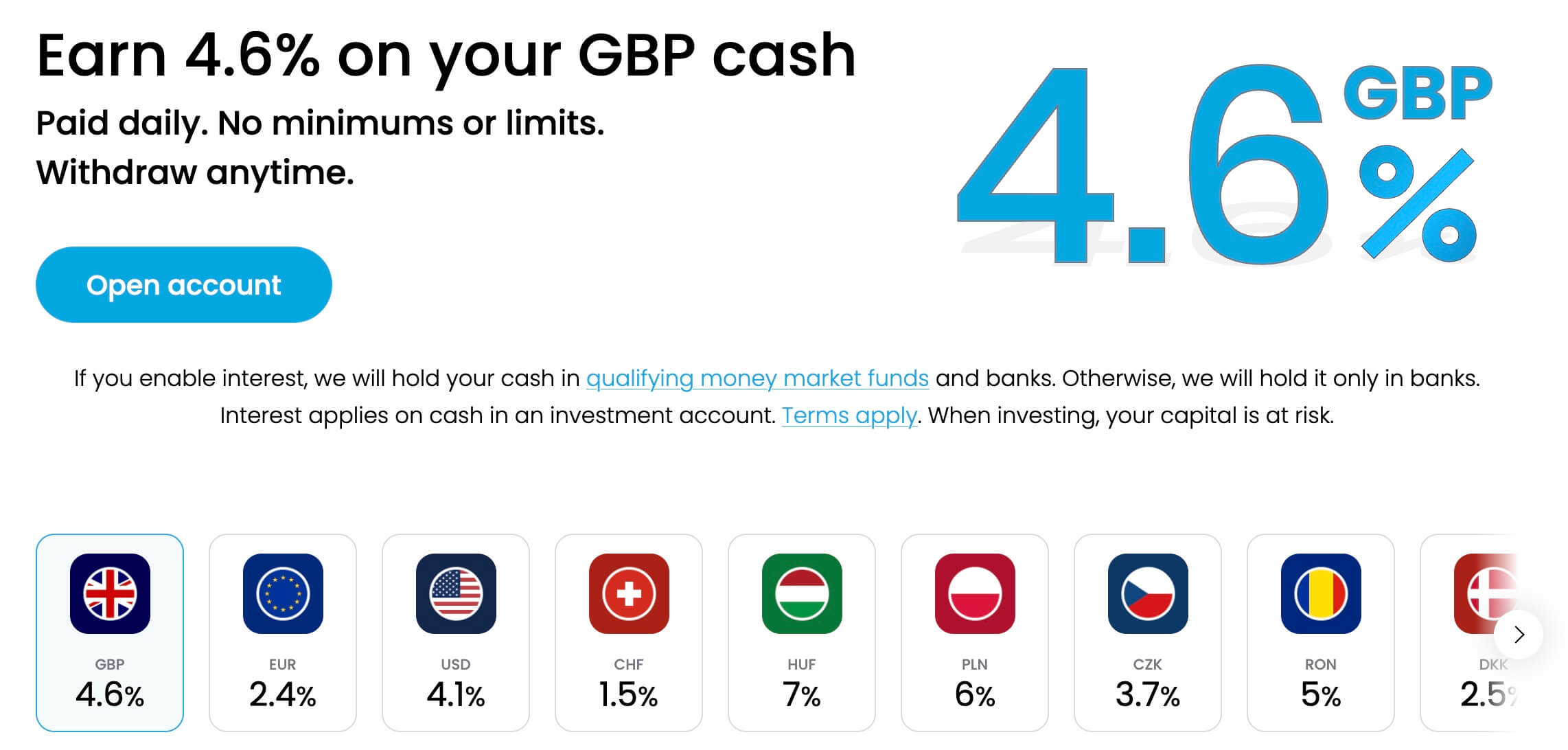

Through Trading 212, higher interest rates are offered on uninvested cash by agreeing to place these funds in QMMFs. The interest rate for QMMFs depends on the currency you select.

Source: Trading 212. The interest rates shown are current as of 8 May 2025. They are linked to central bank rates and may change over time.

Source: Trading 212. The interest rates shown are current as of 8 May 2025. They are linked to central bank rates and may change over time.QMMF trading does involve credit risk, management risk, interest rate risk, and liquidity risk. However, while nothing in the investment world is ever guaranteed, Trading 212 uses QMMFs such as BlackRock’s ICS and JPMorgan’s liquidity funds, which have been active for nearly 30 years and have never decreased in value throughout their history.

QMMFs are one of the safest possible assets available, with trillions of pounds, dollars, and euros invested from major financial institutions. They are less risky than stocks and corporation bonds. During the 2008 crisis, some US MMFs experienced failure, but these were extreme conditions. Other than this, the trading of QMMFs is almost as safe as it gets.

In the Help Centre article on QMMFs, Trading 212 explains how they manage the risks associated with QMMFs and how they safeguard client assets.

QMMFs are one of the safest possible assets available, with trillions of pounds, dollars, and euros invested from major financial institutions. They are less risky than stocks and corporation bonds. During the 2008 crisis, some US MMFs experienced failure, but these were extreme conditions. Other than this, the trading of QMMFs is almost as safe as it gets.

In the Help Centre article on QMMFs, Trading 212 explains how they manage the risks associated with QMMFs and how they safeguard client assets.

Recap

The QMMF is a highly regulated fund that provides low risk returns to investors, through the investment in high quality, liquid assets. Its popularity has increased significantly in recent years due to stricter regulatory requirements for short-term deposits in banks. QMMFs provide similar risk levels, at a lower cost.

Though they are relatively safe, returns are by no means guaranteed, and some offer more protection than others. While the EU and US MMF markets both reached record highs in 2023 and 2024, some industry professionals have voiced concerns about the reliability of trading QMMFs in extreme scenarios such as in the event of a wider systemic failure.

Though they are relatively safe, returns are by no means guaranteed, and some offer more protection than others. While the EU and US MMF markets both reached record highs in 2023 and 2024, some industry professionals have voiced concerns about the reliability of trading QMMFs in extreme scenarios such as in the event of a wider systemic failure.

FAQ

Q: What is considered a Money Market Fund (MMF)?

A Money Market Fund (MMF) is an investment vehicle that holds short-term, high-quality debt securities. Short term in the context of MMFs means less than 1 year but normally they hold securities that expire in 30-90 days. These typically include government bonds, commercial paper, and fixed-term deposits as well as repurchase agreements (repos). Money market funds aim to provide stability, liquidity, and modest returns.

Q: How safe is my money in a MMF?

Money market funds invest in high-quality, short-term debt, making them relatively stable. They aim to maintain a constant Net Asset Value. Unlike bank deposits, MMFs are not insured, but they follow strict regulations on liquidity and credit quality to reduce risk. The main risk comes from market conditions and interest rate changes.

Q: What are the benefits of holding my money with QMMFs versus banks?

QMMF trading offers higher liquidity and competitive yields compared to bank deposits. They allow you as an investor to access institutional-quality investments, which can provide better returns than a typical savings account. Funds are typically diversified across low-risk instruments, reducing exposure. Unlike banks, QMMFs do not engage in lending, which means less exposure to credit risk from borrowers.

Q: What is the downside of MMFs?

Returns on MMFs are linked to interest rates, so they can be low in certain market conditions. Unlike bank accounts, they are not covered by deposit protection schemes. While generally stable, MMFs can experience small fluctuations in value. If market conditions worsen, fund managers may limit withdrawals, making it harder to access cash immediately. This is a rarity, but it can happen.