CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is CFD trading and how does a Contract for Difference work?

CFD trading provides access to a wide range of markets without the need to buy the underlying assets. With CFDs, you can trade stocks, forex, indices, and commodities from a single account.

In this guide, we will explain all you need to know about CFDs and how they can be used to trade the financial markets.

In this guide, we will explain all you need to know about CFDs and how they can be used to trade the financial markets.

Big Ideas

- CFDs are contracts that allow traders to speculate on the future direction of an underlying market by taking either a long or short position.

- Leverage in CFDs allows traders to increase their buying power and open larger positions with a smaller investment.

- CFDs offer advantages such as low cost, a wide range of assets, and the ability to profit from both rising and falling prices, but they also come with high risk and complexity.

What is a CFD?

Every CFD agreement has a buyer and a seller, who agree to exchange the difference between the opening and closing prices of the contract.

If the direction a seller predicted turns out to be correct, then the seller will make a profit based on the magnitude of the price movement. Conversely, if the prediction turns out to be wrong, then the seller will incur losses equal to the difference in value between the opening and closing prices.

Since a CFD is simply a contract between a buyer and seller, no asset transfer is involved. Neither the buyer nor the seller needs to own the underlying asset that is being traded. This helps lower costs and suits the purposes of day traders who are not aiming to become long-term asset holders but rather try to profit from changes in prices.

Since a CFD is simply a contract between a buyer and seller, no asset transfer is involved. Neither the buyer nor the seller needs to own the underlying asset that is being traded. This helps lower costs and suits the purposes of day traders who are not aiming to become long-term asset holders but rather try to profit from changes in prices.

Why do people trade CFDs?

So why not just trade the underlying markets instead of CFDs? You can absolutely do that and many do, but many choose CFDs because of some distinct advantages they have over more traditional financial instruments, namely:

- Speculation without ownership

- Leverage and increased buying power

- Access to a wide range of markets

- Ability to profit in both rising and falling markets

Speculation without ownership

CFDs — Contracts for Difference — let traders take a view on where the market might be headed without owning the asset itself.

Price expected to rise? Open a long position.

Price expected to fall? Open a short position.

Since you do not need to buy/own the asset you are speculating on, the main consideration is the prices you choose to buy and sell at.

Price expected to rise? Open a long position.

Price expected to fall? Open a short position.

Since you do not need to buy/own the asset you are speculating on, the main consideration is the prices you choose to buy and sell at.

Leverage and increased buying power

A small stake, a much bigger position – leverage is what makes that possible in CFD trading. Rather than putting up the full trade value, a trader commits a fraction, with the broker covering the rest.

The upside? Gains are amplified.

The downside? So are the losses.

Every move in the market is felt in full, regardless of how little was initially put down. It can work for or against a trader, and when it turns against, the impact is swift.

The downside? So are the losses.

Every move in the market is felt in full, regardless of how little was initially put down. It can work for or against a trader, and when it turns against, the impact is swift.

Access to a wide range of markets

Shares, indices, forex, commodities and sometimes crypto — CFDs open the door to them all, from a single platform, no separate accounts needed. One moment, it is US equities, the next, it is oil prices or the FTSE 100. No buying or selling of actual assets, just speculation on where they might be going next.

Ability to profit in both rising and falling markets

Up or down — it does not matter with CFDs, as long as you get the direction right. Go long when prices rise, go short when they fall. However, trading involves high risk, and predicting market movements accurately is challenging.

Traditional investing relies on growth, but here, movement is the core driver. A rally or a sell-off — both can be a trade, but as always, timing is everything.

Beyond that, there are overnight funding fees if a trade rolls past the day’s close. Not always as cheap as it looks at first glance, but compared to traditional investing, often a leaner way in.

Traditional investing relies on growth, but here, movement is the core driver. A rally or a sell-off — both can be a trade, but as always, timing is everything.

Beyond that, there are overnight funding fees if a trade rolls past the day’s close. Not always as cheap as it looks at first glance, but compared to traditional investing, often a leaner way in.

Lower costs compared to traditional investing

With CFDs, trading costs work differently. There is no stamp duty on trades, and no need to buy full shares outright. The main cost is the spread — the gap between the buy and sell price — which covers most of it.

Taxes are subject to individual circumstances and can change.

For all their flexibility, CFDs are not without their pitfalls. Leverage can work wonders, until it does not. Markets do not care what a trader expects, and when they move against a position, losses can exceed the initial deposit. Add in spreads, overnight costs, slippage — it all chips away.

Risk management is not optional here; it is the difference between trading and watching capital disappear. We discuss more on the risks of CFD trading below.

Taxes are subject to individual circumstances and can change.

For all their flexibility, CFDs are not without their pitfalls. Leverage can work wonders, until it does not. Markets do not care what a trader expects, and when they move against a position, losses can exceed the initial deposit. Add in spreads, overnight costs, slippage — it all chips away.

Risk management is not optional here; it is the difference between trading and watching capital disappear. We discuss more on the risks of CFD trading below.

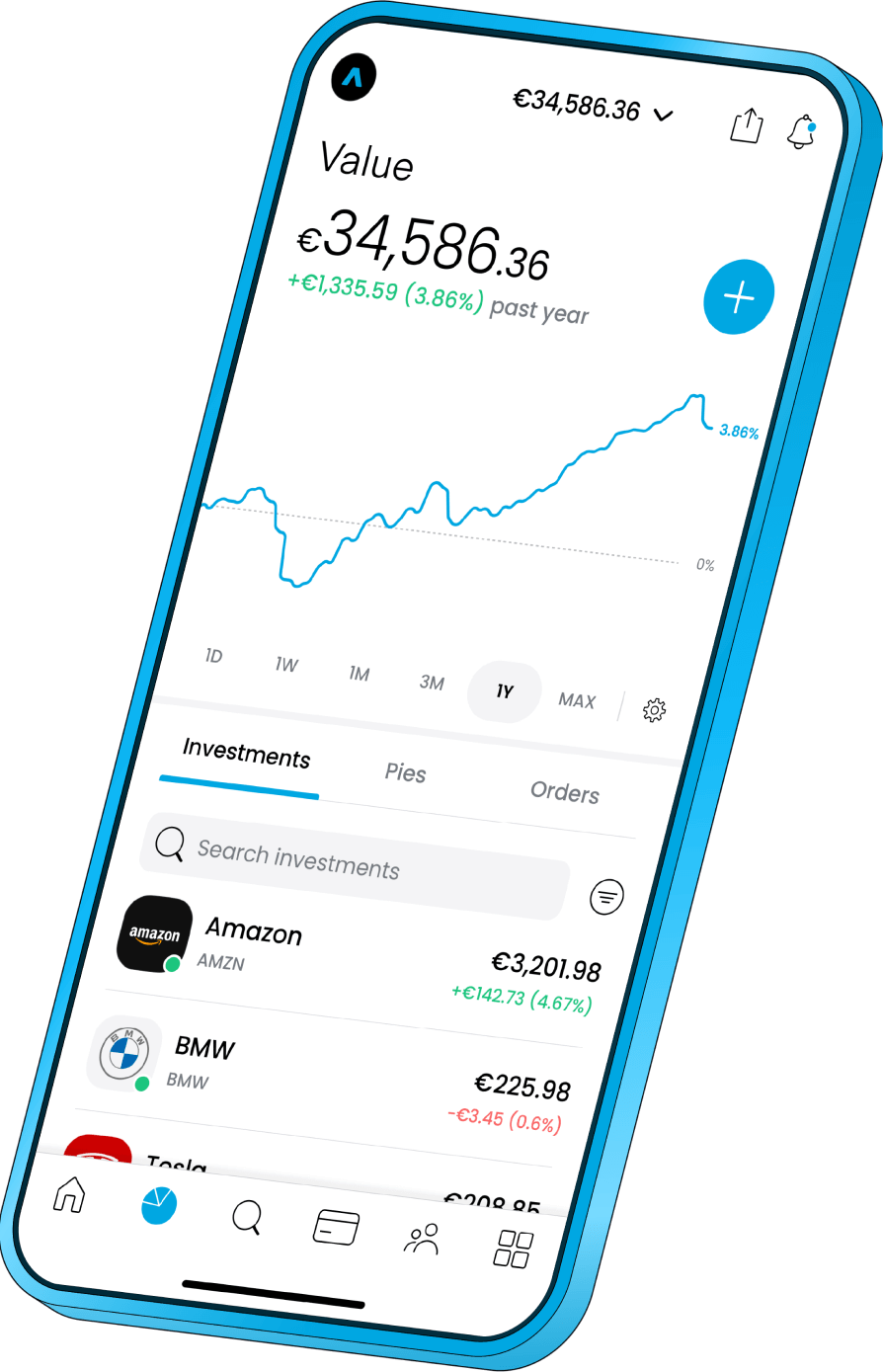

Choosing a CFD trading platform

A CFD trading platform should offer more than just market access — it needs to provide the tools and features that make trading efficient and manageable.

The number of available markets is one consideration, but just as important are execution speed, order types, and overall usability. You will definitely want access to the basic order types like limit orders and stop orders, trailing stops, and guaranteed stop-loss orders to help manage risk, while customisable alerts and real-time news feeds keep you informed about when a trade might be ready to put on.

Beyond execution, most platforms include features like integrated charting tools, economic calendars, and some even have social investing communities where traders can share insights or follow experienced traders. Educational resources, such as webinars and strategy guides are a bonus (well we hope so!), particularly for those still refining their approach.

Of course, the company behind the platform matters a lot. A well-established firm with a solid reputation and responsive customer service can make all the difference when support is needed. Strong regulation is also key — trading with a provider based in a country with strict financial oversight can put your mind at ease over how your funds are handled and that the platform meets high operational standards. A good app is not just about functionality; it is about reliability, security, and trust.

The number of available markets is one consideration, but just as important are execution speed, order types, and overall usability. You will definitely want access to the basic order types like limit orders and stop orders, trailing stops, and guaranteed stop-loss orders to help manage risk, while customisable alerts and real-time news feeds keep you informed about when a trade might be ready to put on.

Beyond execution, most platforms include features like integrated charting tools, economic calendars, and some even have social investing communities where traders can share insights or follow experienced traders. Educational resources, such as webinars and strategy guides are a bonus (well we hope so!), particularly for those still refining their approach.

Of course, the company behind the platform matters a lot. A well-established firm with a solid reputation and responsive customer service can make all the difference when support is needed. Strong regulation is also key — trading with a provider based in a country with strict financial oversight can put your mind at ease over how your funds are handled and that the platform meets high operational standards. A good app is not just about functionality; it is about reliability, security, and trust.

Source: Trading 212. This example is for illustration purposes only and does not constitute financial advice. Past performance is not indicative of future results.

Source: Trading 212. This example is for illustration purposes only and does not constitute financial advice. Past performance is not indicative of future results.With Trading 212, you can go long or short with CFDs and take advantage of tight spreads to keep trading costs low. Negative balance protection ensures you never lose more than your deposit, while 24/7 customer support is always available to assist when needed.

The costs of trading CFDs in simple terms

When trading CFDs (Contracts for Difference), there are several costs involved that traders need to consider. Here is a breakdown of the main expenses:

- Spreads – The difference between the buy and sell price.

- Commissions – Charged by some brokers on CFD trades.

- Swaps (Overnight funding fees) – Interest paid for holding positions overnight.

- Slippage – The difference between expected and actual execution price.

- Market data fees – Accessing real-time market prices can often come with additional charges. However, Trading 212 offers best-in-class market data feeds completely free of charge, providing you with the insights you need to trade confidently.

- Inactivity fees – Applied by some brokers if an account remains unused for a long period. With Trading 212, opening a CFD account is also completely free, and there are no inactivity fees — no matter how long you stay inactive. Other fees may apply once your account is opened – you can check the full list of CFD terms and fees for more details.

Spreads

DEFINITION

The spread is the difference between the bid (sell) price and the ask (buy) price of a CFD.

Brokers make money by widening this spread, which means traders effectively pay a small fee each time they enter a trade.

Tighter spreads generally reduce trading costs.

Wider spreads increase them, especially in volatile markets.

You can check the average spread for a given instrument within a predefined period of time on our Trading Instruments page.

Tighter spreads generally reduce trading costs.

Wider spreads increase them, especially in volatile markets.

You can check the average spread for a given instrument within a predefined period of time on our Trading Instruments page.

Commissions

Some brokers charge a commission on CFD trades, particularly for shares. Instead of earning from the spread, they apply a fixed or percentage-based fee per trade. For example, a broker might charge $5 per trade or 0.1% of the transaction value.

Trading 212 does not apply any commission on your trades.

An FX fee of 0.5% is applied to the results of the closed positions if the currency of the traded instruments differs from the currency of your account.

The overnight interest should be considered if you plan to keep CFD positions open overnight.

Trading 212 does not apply any commission on your trades.

An FX fee of 0.5% is applied to the results of the closed positions if the currency of the traded instruments differs from the currency of your account.

The overnight interest should be considered if you plan to keep CFD positions open overnight.

Swaps (Overnight funding fees)

CFD trading involves leverage, meaning traders borrow money from the broker to open positions. If a position remains open overnight, an interest fee (swap) is charged or credited, depending on whether the position is long (buy) or short (sell) and the interest rate differential between currencies or assets.

Overnight interest formula

Quantity × Overnight Interest (per instrument/position) × Number of Nights

If the traded instrument is forex, the rate is calculated in the second currency of the couple. If your account is in a different currency than the traded instrument, then the current exchange rate between the two currencies will apply.

If the traded instrument is forex, the rate is calculated in the second currency of the couple. If your account is in a different currency than the traded instrument, then the current exchange rate between the two currencies will apply.

Slippage

Slippage occurs when an order is executed at a different price than expected, typically due to market volatility or low liquidity. It can increase trading costs if the actual execution price is worse than the intended entry or exit level.

Market data fees

Some brokers charge fees for access to real-time market data, especially for share CFDs. Traders may need to subscribe to live pricing to make informed decisions, adding to the overall cost.

At Trading 212, real-time data is completely free. We have integrated TradingView — one of the world's most advanced charting tools — directly into the Trading 212 app.

At Trading 212, real-time data is completely free. We have integrated TradingView — one of the world's most advanced charting tools — directly into the Trading 212 app.

Inactivity fees

If a trader does not place trades for an extended period, some brokers charge inactivity fees. These fees vary by broker and can eat into an account balance if not monitored.

At Trading 212, opening a CFD account is completely free, and there are no inactivity fees – regardless of how long you stay inactive. Other fees may apply once your account is opened – you can check the full list of CFD terms and fees for more details.

At Trading 212, opening a CFD account is completely free, and there are no inactivity fees – regardless of how long you stay inactive. Other fees may apply once your account is opened – you can check the full list of CFD terms and fees for more details.

What is the spread in trading?

In every financial market, whether it is forex, stocks, commodities, or CFDs, there is always a spread — the difference between the price at which buyers are willing to purchase (bid) and the price at which sellers are willing to sell (ask). This spread exists due to the fundamental nature of markets where buyers and sellers must agree on a price before a trade can occur.

In many markets, market makers or liquidity providers play a crucial role in maintaining orderly trading. They continuously quote both bid and ask prices, effectively acting as the counterparty to traders. The spread represents the cost of this liquidity service and compensates the market maker for taking on risk.

In many markets, market makers or liquidity providers play a crucial role in maintaining orderly trading. They continuously quote both bid and ask prices, effectively acting as the counterparty to traders. The spread represents the cost of this liquidity service and compensates the market maker for taking on risk.

Example of a CFD spread in action

Let’s say you are trading a CFD on Gold (XAU/USD), and your broker offers the following prices:

Buy (Ask) Price: $2,010.50

Sell (Bid) Price: $2,010.00

The spread = Buy Price - Sell Price

= $2,010.50 - $2,010.00

= $0.50 (50 cents per ounce)

If you buy Gold at $2,010.50, you are immediately in a 50-cent loss per unit because if you were to sell it instantly, you would get only $2,010.00. The market must move at least 50 cents in your favor before you can break even.

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

Buy (Ask) Price: $2,010.50

Sell (Bid) Price: $2,010.00

The spread = Buy Price - Sell Price

= $2,010.50 - $2,010.00

= $0.50 (50 cents per ounce)

If you buy Gold at $2,010.50, you are immediately in a 50-cent loss per unit because if you were to sell it instantly, you would get only $2,010.00. The market must move at least 50 cents in your favor before you can break even.

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

Why does the spread matter?

A narrow spread means traders need a smaller price move to break even or turn a profit. Highly liquid markets like major forex pairs (e.g. EUR/USD) usually have low spreads, whereas less liquid assets (e.g. exotic forex pairs, commodities, and some stocks) tend to have wider spreads.

Market volatility can widen spreads, increasing trading costs unexpectedly.

After-hours trading or trading in low-liquidity markets can also lead to wider spreads.

Market volatility can widen spreads, increasing trading costs unexpectedly.

After-hours trading or trading in low-liquidity markets can also lead to wider spreads.

Spread calculation in different markets

- Forex: Usually measured in pips (e.g. EUR/USD might have a 1.2 pip spread). A pip (short for percentage in point) is the smallest standard unit of price movement in a currency pair. For most forex pairs, a pip represents a 0.0001 change in price, or one-hundredth of a percent. For example, if EUR/USD rises from 1.1000 to 1.1001, that is an increase of 1 pip. However, for currency pairs involving the Japanese yen (e.g. USD/JPY), a pip is measured at 0.01 instead of 0.0001, due to the yen’s lower value.

- Indices: Quoted in points (e.g. US 30 might have a 1.5-point spread). A point represents a full integer movement in an index’s price. For example, if the S&P 500 moves from 4,500 to 4,501, that is a 1-point move. The spread is the difference between the bid and ask price in these points.

- Commodities: Quoted in dollars or cents (e.g. Gold CFD might have a $0.50 spread per ounce). If the bid price for gold is $1,945.50 and the ask price is $1,946.00, the spread is $0.50 per ounce.

- Stocks: Some brokers charge both a spread and a commission, particularly when trading share CFDs. At Trading 212, however, you only pay through the spread – there is no commission on your trades. Brokers offering direct market access often charge a commission alongside very tight – or even zero – spreads. In these cases, the broker’s revenue comes mainly from the commission rather than the spread. Others may offer commission-free trading but use a slightly wider spread to cover their costs. Some CFD providers combine both models, particularly for less liquid assets or when serving professional accounts.

This example is for illustration purposes only and does not constitute financial advice. Past performance is not indicative of future results.

Going long or short with CFDs

A CFD allows traders to speculate on the future direction of an underlying market by going into a long or short position.

DEFINITION

Going long means speculating that the price will rise. You profit when the asset price rises. You lose when the asset price falls. Going long a CFD has the same effect as buying something – making it the most intuitive. Normally you buy something, be it a house, car or antique then sell it later – hopefully at a profit but maybe at a loss.

Going short means speculating that the price will fall. You profit when the asset price falls. You lose when the asset price rises. As you can see – this is just the other way around. You sell something first and then buy it back later, again either with a profit or loss. Since you never take ownership of a CFD, it does not matter if you buy or sell the contract.

Going short means speculating that the price will fall. You profit when the asset price falls. You lose when the asset price rises. As you can see – this is just the other way around. You sell something first and then buy it back later, again either with a profit or loss. Since you never take ownership of a CFD, it does not matter if you buy or sell the contract.

How do CFDs work?

Before you even get started trading CFDs, you need to get to know the main CFD trading terms and how they apply to the trades you want to place.

Bid/Ask spread

The spread affects both buying and selling.

When you buy, you enter at the higher price (ask)

When you sell, you enter at the lower price (bid)

To profit, the price must move beyond the spread in your favour.

When you buy, you enter at the higher price (ask)

When you sell, you enter at the lower price (bid)

To profit, the price must move beyond the spread in your favour.

EXAMPLE

Let's say you want to trade a CFD on Company X stock.

The bid price is $50, and the ask price is $51.

If you decide to buy one CFD contract at the ask price of $51, you immediately incur a loss of $1 (the spread). The market price needs to rise by at least $1 for your trade to break even.

To earn a $2 profit, you would need to wait for the price to rise to $53. However, if the price fell by $2, you would incur a loss of $3 ($1 spread and $2 price change).

In this example, the market price would need to rise by at least $1 just to break even, so any potential profit would only begin once that cost has been exceeded.

The bid price is $50, and the ask price is $51.

If you decide to buy one CFD contract at the ask price of $51, you immediately incur a loss of $1 (the spread). The market price needs to rise by at least $1 for your trade to break even.

To earn a $2 profit, you would need to wait for the price to rise to $53. However, if the price fell by $2, you would incur a loss of $3 ($1 spread and $2 price change).

In this example, the market price would need to rise by at least $1 just to break even, so any potential profit would only begin once that cost has been exceeded.

The spread can vary depending on the asset being traded and market conditions. Major assets with high liquidity often have tighter spreads, meaning the difference between the bid and ask price is smaller. In contrast, assets with lower liquidity may have wider spreads.

Transacting in CFDs

In CFD trading, the contract size refers to the quantity of the underlying asset represented by a single CFD contract. The contract size always varies depending on the asset in question. It is essential to understand the contract size as it directly affects the value of each CFDs price movement.

Larger contract sizes mean greater exposure, which can amplify both profits and losses. Traders should carefully consider their position size in relation to their risk tolerance.

Larger contract sizes mean greater exposure, which can amplify both profits and losses. Traders should carefully consider their position size in relation to their risk tolerance.

- In stock CFDs, one CFD contract may represent one share (or sometimes a multiple or fraction of a share) of the underlying company's stock.

- In index CFDs, one contract may represent a specific monetary value or a fraction of the index's total value.

- In commodity CFDs, one contract may represent a certain quantity of the physical commodity, such as barrels of oil or ounces of gold.

The Trading 212 app shows you the quantity you are buying in units of CFDs. The lowest you can buy is 0.1 of a CFD. Here 1 CFD represents one share of Tesla (TSLA).

Source: Trading 212. This example is for illustration purposes only and does not constitute financial advice. Past performance is not indicative of future results.

Source: Trading 212. This example is for illustration purposes only and does not constitute financial advice. Past performance is not indicative of future results.Understanding the contract size is crucial for calculating the potential profit or loss in a CFD trade, as the contract size will determine the value of each CFDs price movement.

Additionally, traders must consider the contract size when choosing their position size and risk management strategies.

Additionally, traders must consider the contract size when choosing their position size and risk management strategies.

CFD leverage explained

In CFD trading, leverage allows traders to multiply their buying power and open larger positions with a smaller investment or deposit. This means that traders can make larger profits or losses from even relatively small price movements in the underlying asset.

EXAMPLE

You want to buy a stock that is currently trading at $100.

You have $1,000 in your trading account and you decide to open a long position on the stock CFD.

Leverage is 5:1. This means that for every dollar of your own funds in the position, your broker will provide you with an additional $4 from margin funds.

So instead of buying one share of the stock for $100, you can buy five worth $500. You have multiplied your buying power by 5X.

If the price goes up by 5% and reaches $105, then you would make a profit of $25 ($5 × 5) minus fees. However, if the price went down by 5% to $95, you would make a loss of $25 plus fees.

When trading CFDs, margin requirements determine how much of your own funds you need to commit to open a leveraged position. Margin is the portion of the trade that you must provide, while the broker covers the rest through leverage.

In the example, you have $1,000 in your trading account and decide to open a long position on a stock CFD priced at $100 per share with 5:1 leverage. This means you only need to provide 20% of the total position value as margin, while the broker provides the remaining 80%. Since you are buying five shares worth $500, your margin requirement for this trade is $100 ($500 ÷ 5 leverage).

After opening the trade, your reserved funds (margin) will be $100, leaving you with $900 in free funds. If the price moves in your favour, you can profit from the amplified exposure. However, if the market moves against you, your margin utilisation increases, and your available funds decrease.

At Trading 212, the margin indicator tracks your account status to ensure you have sufficient funds to maintain your positions. Your account status is calculated as:

Account status = (Total funds ÷ (Total funds + Reserved funds)) × 100

Since your total funds are $900 and your reserved funds are $100, your margin indicator is:

(900 ÷ (900 + 100)) × 100 = 90%

At this level, you can open additional positions. However, if losses reduce your available funds and your account status falls below 50%, you would not be able to open new trades. At 45%, a margin call is triggered, warning you of low margin. If it drops below 25%, Trading 212 will automatically start closing positions to prevent further losses.

Understanding how margin requirements work is crucial for managing risk and avoiding forced liquidations.

You have $1,000 in your trading account and you decide to open a long position on the stock CFD.

Leverage is 5:1. This means that for every dollar of your own funds in the position, your broker will provide you with an additional $4 from margin funds.

So instead of buying one share of the stock for $100, you can buy five worth $500. You have multiplied your buying power by 5X.

If the price goes up by 5% and reaches $105, then you would make a profit of $25 ($5 × 5) minus fees. However, if the price went down by 5% to $95, you would make a loss of $25 plus fees.

When trading CFDs, margin requirements determine how much of your own funds you need to commit to open a leveraged position. Margin is the portion of the trade that you must provide, while the broker covers the rest through leverage.

In the example, you have $1,000 in your trading account and decide to open a long position on a stock CFD priced at $100 per share with 5:1 leverage. This means you only need to provide 20% of the total position value as margin, while the broker provides the remaining 80%. Since you are buying five shares worth $500, your margin requirement for this trade is $100 ($500 ÷ 5 leverage).

After opening the trade, your reserved funds (margin) will be $100, leaving you with $900 in free funds. If the price moves in your favour, you can profit from the amplified exposure. However, if the market moves against you, your margin utilisation increases, and your available funds decrease.

At Trading 212, the margin indicator tracks your account status to ensure you have sufficient funds to maintain your positions. Your account status is calculated as:

Account status = (Total funds ÷ (Total funds + Reserved funds)) × 100

Since your total funds are $900 and your reserved funds are $100, your margin indicator is:

(900 ÷ (900 + 100)) × 100 = 90%

At this level, you can open additional positions. However, if losses reduce your available funds and your account status falls below 50%, you would not be able to open new trades. At 45%, a margin call is triggered, warning you of low margin. If it drops below 25%, Trading 212 will automatically start closing positions to prevent further losses.

Understanding how margin requirements work is crucial for managing risk and avoiding forced liquidations.

CFDs are leveraged products but not all leveraged products are CFDs. This means that while CFDs allow traders to use leverage to amplify their exposure to price movements, other financial derivatives such as futures, options, and spread betting also offer leverage.

The key difference between CFDs and these other instruments is that CFDs do not have an expiry date like options and futures do. CFDs are also typically traded with a wider range of underlying markets compared to other leveraged products.

The key difference between CFDs and these other instruments is that CFDs do not have an expiry date like options and futures do. CFDs are also typically traded with a wider range of underlying markets compared to other leveraged products.

How does CFD profit and loss work?

When you place a CFD trade, you are aiming to make a certain number of points and make a profit. In doing so you take a risk of losing points and taking a loss.

The additional bit of information for you to know exactly how much you stand to make on any trade beyond the number of points you are targeting is the size of your position. Position size is determined by the size of and how many contracts you buy or sell.

That is really the crux of the whole thing, and it needn’t be overcomplicated.

Mathematically, we can think of it as follows:

The additional bit of information for you to know exactly how much you stand to make on any trade beyond the number of points you are targeting is the size of your position. Position size is determined by the size of and how many contracts you buy or sell.

That is really the crux of the whole thing, and it needn’t be overcomplicated.

Mathematically, we can think of it as follows:

DEFINITION

CFD Profit/Loss = (Closing Price - Opening Price) × Contract Size × Number of Contracts

More specifically:

For a Buy (long) trade:

Profit/Loss = (Sell Price - Buy Price) × Contract Size × Number of Contracts

For a Sell (short) trade:

Profit/Loss = (Buy Price - Sell Price) × Contract Size × Number of Contracts

More specifically:

For a Buy (long) trade:

Profit/Loss = (Sell Price - Buy Price) × Contract Size × Number of Contracts

For a Sell (short) trade:

Profit/Loss = (Buy Price - Sell Price) × Contract Size × Number of Contracts

Step-by-step example of a CFD trade (Gold)

- Choose the market & instrument – Select Gold CFDs from your trading platform.

- Analyse the market – Use technical analysis (charts, trends, support/resistance) and fundamental analysis (interest rates, inflation, geopolitical events).

- Select trade direction – Decide whether to go long (buy) if you expect Gold prices to rise or short (sell) if you expect them to fall. For the sake of this example, let's say you believe gold prices will increase.

- Determine position size – Choose the number of CFD contracts. Example: 1 CFD contract represents $1 per point movement.

- Check the spread – The difference between bid and ask prices. Example: Bid price = $1,950, Ask price = $1,951 (spread = $1). If you buy at $1,951, your trade starts with a -$1 loss.

- Set risk management rules – Place a stop-loss (e.g. $1,945 to limit loss to $6 per contract) and a take-profit (e.g. $1,960 to secure a $9 profit per contract). Consider leverage and margin requirements.

- Place the trade – Use a market order for instant execution or a limit order to enter at a specific price.

- Close the trade – If Gold hits $1,960, you earn $9 per contract. If it drops to $1,945, your stop-loss triggers, limiting the loss to $6 per contract.

- Review & adjust – Analyse performance, refine your strategy, and prepare for the next trade.

Stop-loss execution is subject to market conditions, and slippage may occur in highly volatile markets.

Example scenario recap: Buy 1 Gold CFD at $1,951 (starting with - $1 spread). If Gold rises to $1,960, you make $9. If Gold falls to $1,945, you lose $6. Consider overnight financing costs, margin, and market volatility before trading.

Actual Trade outcomes may vary due to slippage, execution delays, and liquidity conditions.

Example scenario recap: Buy 1 Gold CFD at $1,951 (starting with - $1 spread). If Gold rises to $1,960, you make $9. If Gold falls to $1,945, you lose $6. Consider overnight financing costs, margin, and market volatility before trading.

Actual Trade outcomes may vary due to slippage, execution delays, and liquidity conditions.

How to place a CFD trade in the Trading 212 app

First, make sure you have selected your CFD account if you have multiple accounts.

Source: Trading 212. Image for illustration purposes, not indicative of future performance. Note: The Trading 212 CFD account is not available for users registered with Trading 212 AU.

Source: Trading 212. Image for illustration purposes, not indicative of future performance. Note: The Trading 212 CFD account is not available for users registered with Trading 212 AU.Then choose from the watchlists listed along the top, e.g. Commodities to select from the wide range of stock commodity CFDs.

Source: Trading 212. Image for illustration purposes, not indicative of future performance.

Source: Trading 212. Image for illustration purposes, not indicative of future performance.Choosing your preferred commodity will take you to the screen for the specific instrument that you want to trade, for example Gold (XAUUSD), a CFD representing the price of gold measured against the US Dollar.

Source: Trading 212. Image for illustration purposes, not indicative of future performance.

Source: Trading 212. Image for illustration purposes, not indicative of future performance.From there, you can choose to either pass on the trade or proceed to buy or sell. Clicking Buy will take you to the order screen, where you can arrange a long position in Gold (XAUUSD).

Use the slider to select the quantity of CFDs you wish to buy, and the screen will display the margin requirement and overnight interest charges for that position.

Use the slider to select the quantity of CFDs you wish to buy, and the screen will display the margin requirement and overnight interest charges for that position.

Source: Trading 212. Image for illustration purposes, not indicative of future performance.

Source: Trading 212. Image for illustration purposes, not indicative of future performance.From a risk management standpoint, it is usually advisable to include a take-profit order to lock in your potential profits or cap your potential losses with a stop-loss order.

Source: Trading 212. Image for illustration purposes, not indicative of future performance.

Source: Trading 212. Image for illustration purposes, not indicative of future performance.When you are happy with everything, click Confirm Buy to enter the trade.

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

Past performance is no guarantee of future results. This information is not investment advice. Do your own research. The calculations are hypothetical and intended solely for educational use.

How to become a CFD trader

Here are some steps you need to go through to get started as a CFD trader.

1. Choose a CFD trading platform

There are many brokers out there offering different features and services, so make sure to shop around and find the one that best suits your needs.

Almost every broker offers a demo account to test out strategies in a simulated environment without having to risk any of your own funds. This is a great way to get familiar with the platform, test out some of the features we mentioned earlier – and develop your trading skills before risking real money.

Trading 212 provides web-based trading alongside mobile apps for both iOS and Android, so you can manage your trades on the go, wherever you are.

Additionally, Trading 212 offers a free demo trading account, perfect for beginners or experienced traders looking to familiarise themselves with the platform before committing real funds.

Almost every broker offers a demo account to test out strategies in a simulated environment without having to risk any of your own funds. This is a great way to get familiar with the platform, test out some of the features we mentioned earlier – and develop your trading skills before risking real money.

Trading 212 provides web-based trading alongside mobile apps for both iOS and Android, so you can manage your trades on the go, wherever you are.

Additionally, Trading 212 offers a free demo trading account, perfect for beginners or experienced traders looking to familiarise themselves with the platform before committing real funds.

2. Pick an asset to trade

There are a range of different markets available including stocks, indices, commodities, currencies and cryptocurrencies.

You must make sure that you fully understand the risks associated with each market before taking any positions as some may be more volatile than others.

For instance, cryptocurrencies and penny stocks tend to be more volatile than blue-chip stocks and pose a higher level of risk to traders.

You must make sure that you fully understand the risks associated with each market before taking any positions as some may be more volatile than others.

For instance, cryptocurrencies and penny stocks tend to be more volatile than blue-chip stocks and pose a higher level of risk to traders.

3. Choose a trading style

This all depends on how much time you want to dedicate to trading and the level of risk you are willing to take. There are many niche styles but they can almost all be categorised by duration.

Scalping involves taking quick trades that last less than a minute – these trades can generate small profits but come with high risks.

Day traders look for short-term market movements throughout the day, whereas swing traders typically hold onto positions over multiple days or weeks.

Position traders are more conservative as they tend to hold positions for months or even years until their target profit is hit.

However, traders should keep in mind that holding a position overnight usually incurs a fee with most brokers.

Scalping involves taking quick trades that last less than a minute – these trades can generate small profits but come with high risks.

Day traders look for short-term market movements throughout the day, whereas swing traders typically hold onto positions over multiple days or weeks.

Position traders are more conservative as they tend to hold positions for months or even years until their target profit is hit.

However, traders should keep in mind that holding a position overnight usually incurs a fee with most brokers.

4. Learn a trading strategy

This includes understanding technical and fundamental analysis, as well as staying up-to-date with news and economic releases that could affect the performance of your chosen asset.

Source: TradingView. This example is for illustration purposes only and does not constitute financial advice. Past performance is not indicative of future results.

Source: TradingView. This example is for illustration purposes only and does not constitute financial advice. Past performance is not indicative of future results.Technical analysis involves studying past price action to identify patterns, support and have resistance levels, as well as potential trading opportunities. Fundamental analysis looks at economic factors that could influence the markets, such as central bank policies, political events, and economic indicators.

5. Execute your trades

You can either place a market order or limit order depending on the type of trade you are taking.

Order type | Definition | Execution | Purpose |

Market order | To buy or sell at the best available price in the market at the time the order is placed. | Immediate | To execute the trade quickly at the prevailing market price. |

Limit order | To buy or sell at a specified price or better. The trade will be executed only at the specified price or a more favourable one. | Conditional | To enter a trade at a specific price level. Used to aim for better entry or exit points than the current market price. |

Stop order | To buy or sell once the market reaches a specified price level, known as the stop price. It becomes a market order when the stop price is reached, but execution may occur at a different price due to market conditions. | Conditional | To trigger a trade once the market reaches a certain price level. Used for entering or exiting positions based on price movements. |

6. Risk management

You also need a way to control losses, which will happen on a regular basis because (of course) you cannot win all of your trades. The two main methods to close out a trade are by using a stop loss order and a take profit order.

Take Profit and Stop Loss orders are two essential risk management tools used by traders in CFD trading (and other financial markets) to control potential losses and secure profits. They are conditional orders that automatically execute when a specific price level is reached.

A Take Profit order is an instruction given by a trader to close a position and secure profits once the asset's price reaches a predetermined level. It allows traders to lock in gains and exit the trade when the market moves in their favor. By setting a Take Profit order, traders do not have to monitor the market continuously and can let the order execute automatically.

A Stop Loss order is an instruction given by a trader to close a position and limit potential losses when the asset's price moves against their favor. It helps traders protect their capital and avoid significant losses in volatile markets. If the market price reaches the specified Stop Loss level, the order is triggered, and the position is automatically closed at that price. However, execution may occur at a different price due to market volatility or liquidity conditions.

Take Profit and Stop Loss orders are two essential risk management tools used by traders in CFD trading (and other financial markets) to control potential losses and secure profits. They are conditional orders that automatically execute when a specific price level is reached.

A Take Profit order is an instruction given by a trader to close a position and secure profits once the asset's price reaches a predetermined level. It allows traders to lock in gains and exit the trade when the market moves in their favor. By setting a Take Profit order, traders do not have to monitor the market continuously and can let the order execute automatically.

A Stop Loss order is an instruction given by a trader to close a position and limit potential losses when the asset's price moves against their favor. It helps traders protect their capital and avoid significant losses in volatile markets. If the market price reaches the specified Stop Loss level, the order is triggered, and the position is automatically closed at that price. However, execution may occur at a different price due to market volatility or liquidity conditions.

Examples of CFDs

Before signing up to trade CFDs, it is important to understand the different types of contracts available. The most popular types of CFDs include forex, shares, crypto, indices and commodities.

Share CFDs, also known as Stocks CFDs, are contracts that allow traders to speculate on the price movements of individual stocks without having to physically own them. Share CFDs are available on a range of different stocks from both domestic and overseas exchanges, allowing traders to diversify their portfolios.

At Trading 212, there are thousands of Share CFDs, providing traders with an opportunity to explore different instruments and trading strategies.

At Trading 212, there are thousands of Share CFDs, providing traders with an opportunity to explore different instruments and trading strategies.

Forex CFDs

Forex stands for foreign exchange and a Forex CFD is a contract based on the value of one currency against another. These are some of the most liquid markets in the world with medium to high levels of volatility, depending on the currency pairs being traded.

Forex CFDs are traded as currency pairs, which consist of a base currency and a quote currency. The most popular pairs are known as majors which contain a currency from a major economy, paired with the United States dollar. These include EUR/USD, GBP/USD, and USD/JPY.

Indices CFDs

Indices represent baskets of securities that track the performance of particular markets or sectors. For example, the S&P 500 is a widely followed index that tracks the performance of 500 leading companies listed on the US stock market.

By trading index CFDs, traders can speculate on the price movements of an entire basket of stocks without having to buy and sell each one individually. This helps to diversify risk as any losses in individual stocks will be offset by gains elsewhere in the portfolio.

By trading index CFDs, traders can speculate on the price movements of an entire basket of stocks without having to buy and sell each one individually. This helps to diversify risk as any losses in individual stocks will be offset by gains elsewhere in the portfolio.

Cryptocurrency CFDs

Cryptocurrencies have exploded in popularity over the past few years and are now some of the most traded assets on the market. Cryptocurrencies are digital currencies that use cryptography to secure their transactions and create new units.

CFD traders can speculate on the price movements of different cryptocurrencies without actually owning them. The most popular tokens to trade as CFDs include Bitcoin and Ethereum. Cryptocurrency CFDs provide access to leveraged trades with low commissions and potentially tighter spreads.

Note that the amount of leverage available for crypto CFDs is usually less because of the inherently volatile underlying market.

CFD traders can speculate on the price movements of different cryptocurrencies without actually owning them. The most popular tokens to trade as CFDs include Bitcoin and Ethereum. Cryptocurrency CFDs provide access to leveraged trades with low commissions and potentially tighter spreads.

Note that the amount of leverage available for crypto CFDs is usually less because of the inherently volatile underlying market.

Commodity CFDs

Commodities are physical assets such as oil, gold, and silver that are openly traded on the financial market.

Trading commodities CFDs allows traders to profit from the rise and fall in commodity prices without actually having to buy or sell the underlying metal, energy or agricultural product.

Holding physical commodities such as gold or silver can be cumbersome and expensive, but with CFDs, traders can take advantage of the movements in underlying prices quickly and cost-effectively.

Trading commodities CFDs allows traders to profit from the rise and fall in commodity prices without actually having to buy or sell the underlying metal, energy or agricultural product.

Holding physical commodities such as gold or silver can be cumbersome and expensive, but with CFDs, traders can take advantage of the movements in underlying prices quickly and cost-effectively.

CFD regulations across the globe

CFD trading is regulated differently across various countries, with each financial authority imposing its own rules to protect investors and ensure fair trading practices. While CFDs provide traders with leverage and flexibility, strict regulations are in place to mitigate risks and prevent exploitative practices.

CFD regulations in the UK

It is important to note that all CFD brokers operating within the United Kingdom must comply with regulations put in place by the Financial Conduct Authority (FCA). These rules are designed to protect investors from financial losses and ensure a fair trading environment.

The FCA also requires all brokers offering CFDs within its jurisdiction to provide clients with certain information including any fees or charges applied, margin requirements, the risks involved in trading and risk management tools such as stop-loss orders.

The regulator also ensures that CFD brokers are vocal about the risks of trading and tell their clients the percentage of retail traders that make losses. Brokers are also not allowed to provide financial or non-financial inducements to solicit clients.

The FCA also requires all brokers offering CFDs within its jurisdiction to provide clients with certain information including any fees or charges applied, margin requirements, the risks involved in trading and risk management tools such as stop-loss orders.

The regulator also ensures that CFD brokers are vocal about the risks of trading and tell their clients the percentage of retail traders that make losses. Brokers are also not allowed to provide financial or non-financial inducements to solicit clients.

CFD regulations in Australia

In Australia, CFDs are regulated by the Australian Securities and Investments Commission (ASIC), which sets strict rules to protect retail traders and limit their risk exposure. To help safeguard investors, ASIC imposes leverage restrictions, capping the amount of leverage available for different asset classes.

Brokers must also provide negative balance protection, ensuring that traders cannot lose more than they have deposited. At the same time, offering bonuses or incentives to encourage CFD trading is not allowed.

ASIC also requires brokers to be transparent about the risks involved, including disclosing the percentage of retail traders who lose money. These regulations are in place to promote fairness, improve risk management, and prevent traders from taking on excessive financial exposure.

Brokers must also provide negative balance protection, ensuring that traders cannot lose more than they have deposited. At the same time, offering bonuses or incentives to encourage CFD trading is not allowed.

ASIC also requires brokers to be transparent about the risks involved, including disclosing the percentage of retail traders who lose money. These regulations are in place to promote fairness, improve risk management, and prevent traders from taking on excessive financial exposure.

CFD regulations in Germany

In Germany, CFDs are regulated by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), one of the most stringent financial authorities in Europe.

BaFin strictly prohibits the marketing, distribution, and sale of CFDs that expose retail investors to unlimited losses, ensuring that traders cannot lose more than their account balance. Like other regulators, it also enforces negative balance protection, meaning traders can never owe more than they have deposited.

Transparency is a key focus, with brokers required to clearly disclose the risks involved and the percentage of retail traders who lose money. Germany’s approach to CFD regulation aims to minimise financial risk for retail traders while maintaining a fair and stable market.

BaFin strictly prohibits the marketing, distribution, and sale of CFDs that expose retail investors to unlimited losses, ensuring that traders cannot lose more than their account balance. Like other regulators, it also enforces negative balance protection, meaning traders can never owe more than they have deposited.

Transparency is a key focus, with brokers required to clearly disclose the risks involved and the percentage of retail traders who lose money. Germany’s approach to CFD regulation aims to minimise financial risk for retail traders while maintaining a fair and stable market.

CFD regulations in Cyprus

In Cyprus, CFD trading is regulated by the Cyprus Securities and Exchange Commission (CySEC), a well-known financial authority within the European Union. As a member of the EU, Cyprus-based brokers must comply with the Markets in Financial Instruments Directive II (MiFID II), which ensures a harmonised regulatory framework across all EU member states.

CySEC requires all licensed brokers offering CFDs to retail clients to adhere to strict standards aimed at protecting investors and maintaining market integrity. Brokers must provide negative balance protection, ensuring that retail traders cannot lose more than their deposited funds. Additionally, CySEC enforces leverage limits, capping leverage at 30:1 for major forex pairs and lower ratios for riskier assets such as commodities and individual stocks.

Transparency is a fundamental requirement under CySEC’s regulations. Brokers are obliged to clearly disclose all relevant information, including fees, spreads, margin requirements, and the percentage of retail traders who incur losses when trading CFDs. This information must be readily accessible and presented in a clear, understandable manner.

CySEC also prohibits brokers from offering bonuses or financial incentives to attract retail clients. Furthermore, brokers must implement risk management tools such as stop-loss orders to help traders manage their exposure effectively.

Overall, CySEC’s approach is designed to ensure that CFD trading remains fair and transparent, while safeguarding retail investors from excessive risk. Cyprus’s regulatory framework is particularly attractive to brokers due to its alignment with EU standards, making it a popular jurisdiction for financial services companies operating across Europe.

CySEC requires all licensed brokers offering CFDs to retail clients to adhere to strict standards aimed at protecting investors and maintaining market integrity. Brokers must provide negative balance protection, ensuring that retail traders cannot lose more than their deposited funds. Additionally, CySEC enforces leverage limits, capping leverage at 30:1 for major forex pairs and lower ratios for riskier assets such as commodities and individual stocks.

Transparency is a fundamental requirement under CySEC’s regulations. Brokers are obliged to clearly disclose all relevant information, including fees, spreads, margin requirements, and the percentage of retail traders who incur losses when trading CFDs. This information must be readily accessible and presented in a clear, understandable manner.

CySEC also prohibits brokers from offering bonuses or financial incentives to attract retail clients. Furthermore, brokers must implement risk management tools such as stop-loss orders to help traders manage their exposure effectively.

Overall, CySEC’s approach is designed to ensure that CFD trading remains fair and transparent, while safeguarding retail investors from excessive risk. Cyprus’s regulatory framework is particularly attractive to brokers due to its alignment with EU standards, making it a popular jurisdiction for financial services companies operating across Europe.

CFD Regulations vary by country

While the UK, Australia, and Germany have well-defined regulatory frameworks, CFD trading rules vary from country to country. In some regions, such as the United States, CFDs are completely banned for retail investors, whereas in others, like Singapore and Switzerland, brokers must meet additional licensing requirements.

Leverage limits, risk disclosure obligations, and investor protections differ depending on the jurisdiction, meaning traders need to be aware of the specific rules that apply to them.

Before trading CFDs, it is important to understand the regulations in your country, as these can directly impact your trading options and the level of protection you receive. Choosing a broker that is fully licensed and compliant with local laws is essential for a safe and secure trading experience.

Leverage limits, risk disclosure obligations, and investor protections differ depending on the jurisdiction, meaning traders need to be aware of the specific rules that apply to them.

Before trading CFDs, it is important to understand the regulations in your country, as these can directly impact your trading options and the level of protection you receive. Choosing a broker that is fully licensed and compliant with local laws is essential for a safe and secure trading experience.

Pros and cons of trading CFDs

Deciding whether CFD trading is right for you requires an understanding of both the advantages and disadvantages it offers. Let's dive into the pros and cons of trading with CFD.

Pros of CFD Trading | Cons of CFD Trading |

Leverage: The higher leverage allows traders to control larger positions with smaller capital investments. | High risk: Using leverage also magnifies potential losses, leading to higher risk and potential for significant losses. |

Access to various assets: CFDs provide access to a wide range of underlying assets, including stocks, indices, commodities, currencies, and cryptocurrencies. | Complexity: CFD trading can be complex and requires a good understanding of markets, risk management, and trading strategies. |

Short selling: CFDs enable traders to go short and profit from falling prices, providing opportunities in bearish markets. | No ownership: CFD traders do not own the underlying asset, which means they are not entitled to dividends or shareholder voting rights. |

Diverse trading opportunities: Various trading opportunities, including day trading, swing trading, and position trading. | Costs and fees: Involves costs such as spreads, commissions, and overnight swap fees, which can impact profitability. |

Hedging: CFDs can be used for hedging purposes to offset potential losses in other investments. | Counterparty risk: CFD trading involves dealing with brokers, and there is a risk of the broker's financial stability and ability to fulfill obligations. |

No expiry date: CFDs do not have expiration dates, allowing traders to hold positions for as long as they choose. | Price discrepancies: CFD prices may slightly deviate from the actual market prices due to factors like spreads and broker liquidity. |

Accessible to retail traders: CFDs are easily accessible to retail traders, providing an opportunity to participate in various markets. | Regulatory risks: Trading CFDs with unregulated or offshore brokers may expose traders to higher regulatory risks and limited investor protections. |

CFD trading vs Investing in stocks

While stock trading involves buying shares in a company and holding them over time, CFD trading only requires traders to speculate on the price movements of an underlying asset through contracts (trade orders).

Think of CFDs as a type of derivative instrument, as they are derived from the price movements of an underlying asset. Stocks, however, are parts of a company's equity that can be bought and sold on a stock exchange.

Think of CFDs as a type of derivative instrument, as they are derived from the price movements of an underlying asset. Stocks, however, are parts of a company's equity that can be bought and sold on a stock exchange.

What are stocks CFDs?

Stocks can be traded as CFDs but there are other differences between buying the actual shares and stocks CFDs. For instance, stocks may come with voting rights, while stocks and shares CFDs do not. Additionally, stock dividends are distributed to shareholders, whereas CFDs are not eligible for dividends.

In the UK, CFD trading does not attract stamp duty which is applicable for stock trading. This means that CFD traders may save on costs compared to those trading stocks directly. However, CFDs involve other costs, which may impact the overall trading expenses.

In the UK, CFD trading does not attract stamp duty which is applicable for stock trading. This means that CFD traders may save on costs compared to those trading stocks directly. However, CFDs involve other costs, which may impact the overall trading expenses.

CFD trading vs spread betting

CFD trading and spread betting are two popular derivatives instruments used by traders. While their purpose is similar – to speculate on the price movements of an asset – there are some key differences to be aware of.

Feature | CFD Trading | Spread betting |

Position size | Traded in contracts (e.g. 1 CFD = 1 unit of the asset) | Traded in pounds per point (e.g. £1 per point movement) |

Profit/Loss calculation | Done using the Contract Size and Number of Contracts | Done using the stake (£ per point) |

Tax treatment (UK) | Capital Gains Tax (CGT) applicable, but losses can be offset against profits | Tax-free (no CGT or Stamp Duty) |

Costs & fees | Spread + Commissions (on some assets) + Overnight financing fees | Spread & overnight financing fees |

Market availability | Global stocks, indices, forex, commodities, cryptos | Similar range of markets, but may vary between brokers |

Trading accounts | CFD trading account required | Spread betting account required (UK & Ireland only) |

Leverage & margin | Available and subject to regulatory limits | Available and subject to regulatory limits |

Expiration | No fixed expiry, unless specified | Typically no expiry, but some spread bets may have a fixed duration |

Regulations | FCA-regulated in the UK, but globally available | Only available in the UK & Ireland, FCA-regulated |

Quick summary

- CFDs are based on contract size and subject to Capital Gains Tax.

- Spread betting is based on pounds per point and is tax-free in the UK.

- Both involve leverage, spreads, and overnight financing costs.

Spread Betting vs CFD Trading Tax in the UK

One of the big distinctions between CFDs and spread betting is the way profits are taxed – while CFD profits are subject to capital gains tax, spread betting winnings are not, though may be liable for capital gains tax should you exceed your annual allowance.

Taxes depend on individual circumstance and are subject to change.

Taxes depend on individual circumstance and are subject to change.

Conclusion: Is CFD trading right for me?

What is it you are actually trying to achieve?

How much time are you willing to put into developing a trading strategy and actually trading the markets?

How tolerant are you to risk, and how much do you have to put into this?

These are some of the questions you need to ask yourself (because nobody else can) before you start CFD trading.

CFD trading is designed for short-term speculation, allowing traders to capitalise on price movements using leverage. CFDs are typically used for active trading, often requiring frequent decision-making and risk management. CFD trading is a contract-based approach where profits and losses depend on market fluctuations.

If you are looking for long-term wealth building, traditional investing might be a better fit, offering lower risk, dividend income, and potential tax advantages. However, if you want to trade actively, capitalise on both rising and falling markets, and are prepared to manage the risks of leverage, CFDs can be a useful tool. Ultimately, the right choice depends on you – so consider what truly suits your financial objectives.

How much time are you willing to put into developing a trading strategy and actually trading the markets?

How tolerant are you to risk, and how much do you have to put into this?

These are some of the questions you need to ask yourself (because nobody else can) before you start CFD trading.

CFD trading is designed for short-term speculation, allowing traders to capitalise on price movements using leverage. CFDs are typically used for active trading, often requiring frequent decision-making and risk management. CFD trading is a contract-based approach where profits and losses depend on market fluctuations.

If you are looking for long-term wealth building, traditional investing might be a better fit, offering lower risk, dividend income, and potential tax advantages. However, if you want to trade actively, capitalise on both rising and falling markets, and are prepared to manage the risks of leverage, CFDs can be a useful tool. Ultimately, the right choice depends on you – so consider what truly suits your financial objectives.

Recap

Trading Contracts for Difference can be a useful tool for speculating on the price movements of an underlying asset. Like other trading instruments, CFDs come with both risks and rewards and it is important to educate yourself on CFD trading risks before participating in the market.

FAQ

Q: What is a CFD account?

A CFD account is a type of trading account which allows you to trade Contracts for Difference (CFDs). These are derivatives instruments based on underlying assets such as stocks, indices, commodities or cryptocurrencies. A CFD account gives you access to leverage, allowing you to open larger positions than would be possible with the amount of capital available in your account.

Q: What is leverage in finance?

Leverage is a financial term used to describe the use of borrowed money to increase the potential return on investment. In CFD trading, leverage allows traders to increase their buying power and open positions that are larger than what they could normally afford with the amount of capital in their accounts.

Q: How do I get into CFD trading?

Getting started with CFD trading requires an understanding of how markets work, how to manage risk and a familiarity with technical analysis. Before diving into trading markets it is important to practice first on a demo account and build up experience before graduating to a live trading account.

Q: Should I trade CFDs or invest in stocks?

The decision between which trading instrument to use for your investments depends on the type of trader you are, as well as what your objectives and goals are. For example, if you prefer passive investing with regular income streams then stocks may be more suitable than CFDs. However, if you have a higher risk appetite and are looking to take advantage of short-term price movements then trading CFDs could be a better option.

Q: Is CFD better than investing?

It is difficult to say definitively whether one approach is better than the other as it depends on individual investor preferences and objectives. Some investors may find that they are more comfortable with the longer-term approach of investing in stocks, while others may thrive on the frequency and potential profits offered by CFD trading.

Q: Is CFD trading legal in the UK?

Yes, CFD trading is legal in the UK, but traders must ensure they are using an authorised provider. The Financial Conduct Authority (FCA) regulates brokers providing financial services in the UK including contracts for difference. It’s important to always check that your broker is FCA regulated before opening a live account.